- What is a Bank

- Difference between a Bank and NBFC

- Different Types of Banks

- Issues and Challenges in Banking Sector

- Measures taken to contain NPA’s

- Twin Balance Sheet Problem

- Insolvency and Bankruptcy Code

- Financial Resolution and Deposit Insurance Bill, 2017

- Narasimham Committee – 1

- Narasimham Committee – 2

- Damodaran Committee

- Nachiket Mor Committee

- Basel Norms

- Capital Adequacy Ratio

What is a Bank: A bank is an institution which accepts deposits from the public and in turn advances loans by creating credit. The act of lending and borrowing creates both credit and debit.

“Debt represents money that has been borrowed but not yet been paid back, Credit represents money available to be borrowed.”

The deposits accepted by the bank are considered to be its liabilities, whereas the loans/advances extended are considered as assets of bank.

Q) Which of the following is not included in the assets of a commercial bank in India?

(a) Advances

(b) Deposits

(c) Investments

(d) Money at call and short notice

Deposit Insurance Credit Guarantee Corporation(DICGC):

- Deposit Insurance: It is a protection cover against losses accruing to bank deposits if a bank fails financially and has no money to pay its depositors and has to go in for liquidation.

- It will provide funds up to Rs 5 lakh to an account holder within 90 days in the event of a bank coming under the moratorium imposed by the Reserve Bank of India (RBI).

Earlier, account holders had to wait for years till the liquidation or restructuring of a distressed lender to get their deposits that are insured against default.

The premium is paid by banks to the DICGC, It has been raised from 10 paise for every Rs 100 deposit, to 12 paise and a limit of 15 paise has been imposed.

- It will provide funds up to Rs 5 lakh to an account holder within 90 days in the event of a bank coming under the moratorium imposed by the Reserve Bank of India (RBI).

- Credit Guarantee: It is the guarantee that often provides for a specific remedy to the creditor if his debtor does not return his debt.

What is Non-banking Financial Company (NBFC): NBFCs are those which provide banking services without meeting the legal definition of a bank. An NBFC is incorporated under the Companies Act, 2013 and are desirous of commencing business of non-banking financial institution as under Section 45I(a) of the RBI Act, 1934.

However, the companies cannot be NBFCs if their primary business is related to agricultural activity, industrial activity, sale/purchase/construction of immovable property.

Usually the 50-50 test is used as an anchor to register an NBFC with RBI. 50-50 means that the companies at least 50% assets are financial assets and its income from financial assets is more than 50% of the gross income.

NBFCs are doing functions similar to banks. What is difference between banks & NBFCs?

NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few differences as given below:

|

Basic |

NBFCs |

Banks |

|

Meaning |

They provide banking services to people without holding bank license |

It is a government authorized financial intermediary which aims at providing banking services to the public |

|

Regulated by |

Companies Act 2013 |

Banking Regulation Act 1949 |

|

Demand Deposit |

Cannot be accepted |

Can be accepted |

|

Foreign investment |

Allowed up to 100% |

Allowed up to 74% for private sector banks |

|

Payment and settlement system |

Not a part of the system |

An integral part of the system |

|

Maintenance of Reserve Ratios |

Not required |

Mandatory |

|

Deposit Insurance Facility |

Not available |

Available |

|

Credit creation |

NBFC does not create credit |

Banks create credit |

|

Transaction services |

Cannot be provided by NBFC |

Provided by banks |

Q) With reference to the Non-banking Financial Companies (NBFCs) in India, consider the following statements:

1. They cannot engage in the acquisition of securities issued by the government.

2. They cannot accept demand deposits like Savings Account Which of the statement given above is/ are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither I nor 2

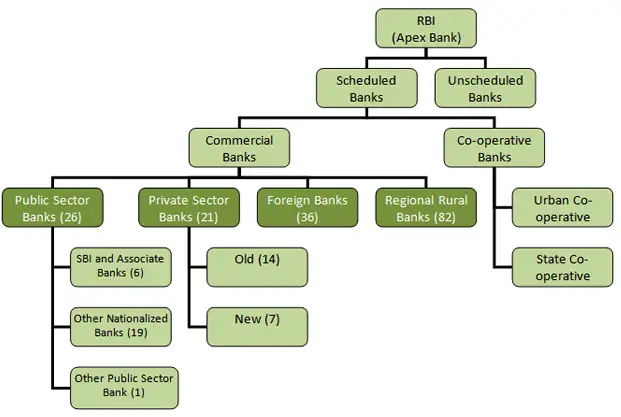

Types of Banks: The banking system in India consists of

Commercial Banks – A commercial bank is a business organization which deals money; it borrows and lends money. In this process of borrowing and lending of money it makes profit.

1.(a). Public Sector Banks: They are owned by the Government- either totally or as a majority stake holder. State Bank of India and its five associate banks called the State Bank group.

19 nationalised banks( earlier there were 7 associate banks but recently 2 were merged with SBI- SB of Saurashtra and Indore)

Regional Rural Banks mainly sponsored by Public Sector Banks.

Q) With reference to the governance of public sector banking in India, consider the following statements

1. Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

2. To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Regional Rural Banks (RRBs): They were set up as government-sponsored, regional based rural lending institutions under the Regional Rural Banks Act, 1976. RRBs were configured as hybrid micro banking institutions, combining the local orientation and small scale lending culture of the cooperatives and the business culture of commercial banks.

Their mission was to fulfil the credit needs of the relatively unserved sections in the rural areas -small and marginal farmers, agricultural labourers and socio-economically weaker sections. Shareholding pattern of RRBs among the three sponsoring entities is 50:35:15 among central government, sponsoring bank and state government respectively.

1.(b). Private Sector Banks: Banks where greater parts of state or equity are held by the private shareholders and not by government. These include domestic and foreign banks.

1.(c). Foreign Banks: Foreign banks are those banks whose branch offices are in India but they are incorporated outside India, and have their head office in a foreign country. These banks were allowed to set up their subsidiaries in India from the year 2002. They have to operate their business by following all the rules and regulations laid down by the RBI -Reserve Bank of India.

2. Co-operative Banks: These are another class of banks and are not considered as commercial banks as they have social objectives and profit is not the motive. Co-operative Banks are subject to CRR and SLR requirements as other banks. However, their requirements are less than commercial banks.

Examples: The Andhra Pradesh State Co-operative Bank Ltd., The Uttaranchal Rajya Sahakari Bank Ltd. etc.

Commercial bank vs Cooperative bank:

- Commercial banks are governed by the Banking Regulation Act. Co-operative banks are governed by the Co-operative Societies Act of 1904. ‘.Commercial banks are subject to the control of the Reserve Bank of India directly. Co-operative banks are subject to the rules laid down by the Registrar of Co-operative Societies.

- Co-operative banks have lesser scope in offering a variety of banking services than commercial banks.

- Commercial banks in India are on a larger scale. They have adopted the system of branch banking, so they have countrywide operations. Co-operative banks are relatively on a much smaller scale. Many co-operative banks follow only unit-bank system, though there are cooperative banks with a number of branches but their coverage is not countrywide.

- Commercial banks mostly provide short-term finance to industry, trade and commerce, including priority sectors like exports, etc.

|

Cooperative Banks |

Commercial Banks |

|

Cooperative Banks are co-operative societies governed by the co-operative societies Act, 1904. |

Commercial banks are joint stock companies they are governed by the Banking Regulation Act, 1949. |

|

Cooperative Banks generally provide short, medium and long term finance to agriculture and allied sectors. |

Commercial Banks generally provide short, medium and long term finance, to trade, commerce and industry. |

|

Cooperative Banks lend finance to their members only i.e., shareholders borrow from a co-operative bank. |

Commercial Banks lend to anyone who is willing to borrow and satisfies the conditions of the bank. |

|

Cooperative Banks operate on a relatively small scale. |

Their operations are on a large scale. |

|

Scope of activities of a co-operate bank is limited to providing different types of loans to their members. |

Commercial banks offers a wide range of financial assistance and financial services. |

|

Cooperative banks operate as federal structure in India. |

Commercial banks have the structure of a joint stock company. |

|

Co-operative Banks are subject to the supervision of the state governments, NABARD and the RBI. |

Commercial Banks come directly under the supervision of the Reserve Bank of India. |

Q) Consider the following statements:

1. In terms of short-term credit delivery to the agriculture sector, District Central Cooperative Banks (DCCBs) deliver more credit in comparison to Scheduled Commercial Banks and Regional Rural Banks

2. One of the most important functions of DCCBs is to provide funds to the Primary Agricultural Credit Societies.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

3. Development Bank: Defined as a financial institution concerned with providing all types of financial assistance (medium as well as long term) to business units, in the form of loans, underwriting, investment and guarantee operations, and promotional activities — economic development in general, and industrial development, in particular. It is essentially a multi-purpose financial institution with a broad development outlook. In short, a development bank is a development- oriented bank.

Examples: Industrial Finance Corporation of India (IFCI) ;Industrial Development Bank of India (IDBI) ;Industrial Credit and Investment Corporation of India (ICICI) that was merged with the ICICI Bank in 2000 ;Industrial Investment Bank of India (IDBI) ;Small Industries Development Bank of India (SIDBI) ;National Bank for Agriculture and Rural Development (NABARD) ;Export Import Bank of India; National Housing Bank(NHB).

What are Scheduled Commercial banks:

Today all banks are broadly classified into two types – Scheduled Banks and Non- scheduled Banks. Scheduled banks are those banks which are included in the Second Schedule of the Reserve Bank Act, 1934. They satisfy two conditions under the Reserve Bank of India Act

- Paid-up capital and reserves of an aggregate value of not less than Rs 5 lakh.

- Any activity of the bank will not adversely affect the interests of depositors

- Every Scheduled bank enjoys the following facilities

- Such bank becomes eligible for debts/loans on bank rate from the RBI

- Such banks automatically acquire the membership of clearing house.

Non-scheduled banks are those banks which are not included in the second schedule of the RBI Act as they do not comply with the above criteria and so they do not enjoy the benefits either.

Status of banking sector at a glance: The Indian banking system consists of 26 public sector banks, 20 private sector banks, 43 foreign banks, 56 regional rural banks, 1589 urban cooperative banks and 93550 rural cooperative banks.

Q) Which of the following grants/ grant direct credit assistance to rural households?

1. Regional Rural Banks

2. National Bank for Agriculture and Rural Development

3. Land Development Banks

Select the correct answer using the codes given below.

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1,2 and 3

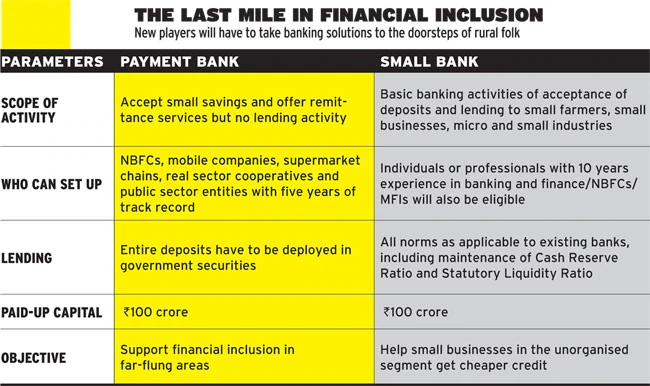

Small Finance Bank: SFBs in India are a category of banks established to provide basic banking services and credit facilities to underserved sections of the population, including small business owners, micro and small industries, farmers, and the unorganized sector.

Also, according to RBI, if an SFB aspires to transit into a universal bank, it has to have a satisfactory track record of performance for a minimum period of 5 years.

Have to allocate 75% of their total net credit to priority sector lending, as per the RBI guidelines.

Eg: AU Small finance Bank, Utkarsh Small finance Bank

Payment Bank: These are banks that can accept a maximum deposit of Rs. 2,00,000. It can accept demand deposits in the form of savings and current accounts. cannot issue loans and credit cards. It cannot accept time deposits or NRI deposits.

- The money received as deposits can be invested in secure government securities only in the form of Statutory Liquidity Ratio (SLR). This must amount to 75% of the demand deposit balance.

- The remaining 25% is to be placed as time deposits with other scheduled commercial banks.

Eg: Airtel Payment Bank, Paytm Payment Bank

Q) The establishment of ‘Payment Banks’ is being allowed in India to promote financial inclusion, Which of the following statements is/are correct in this context?

1. Mobile telephone companies and supermarket chains that are owned and controlled by residents are eligible to be promoters of Payment Banks.

2. Payment Banks can issue both credit cards and debit cards.

3. Payment Banks cannot undertake lending activities.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 1 and 3 only

(c) 2 only

(d) 1,2 and 3

Q) What is the purpose of setting up of Small Finance Banks (SFBs) in India?

1. To supply credit to small business units

2. To supply credit to small and marginal farmers

3. To encourage young entrepreneurs to set up business particularly in rural areas.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1,2 and 3

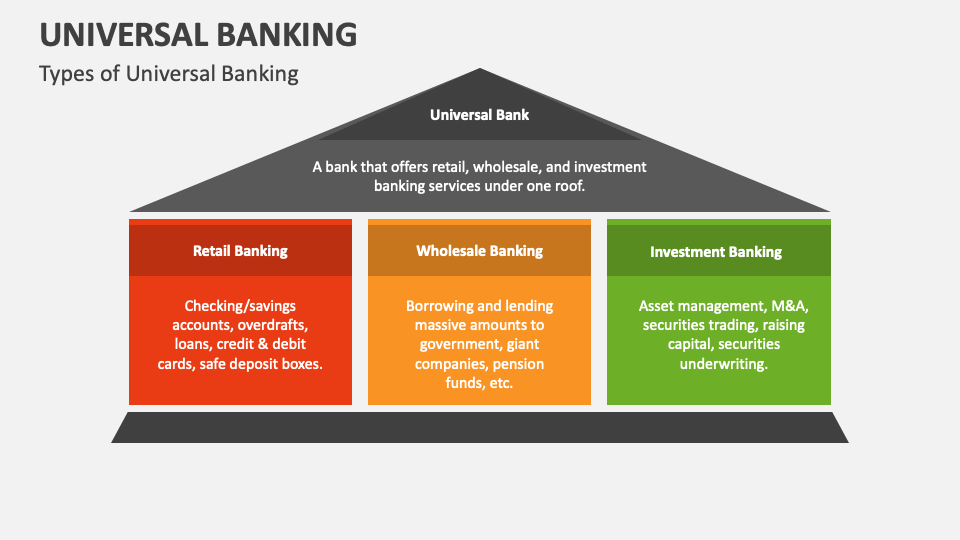

Universal Bank:

Universal banking refers to a banking model that offers a comprehensive range of financial services, including retail, wholesale, and investment banking, and other financial services such as insurance and mutual funds, under one roof.

Core Banking Solution:

A core banking solution (CBS) is a software used by banks to manage primary operations. It is a centralized system that allows customers or businesses to carry out transactions from any branch rather than only from the branch where the account was opened.

It streamlines and centralises banking operations for any bank or NBFC. With a robust CBS, banks can manage various account activities like deposits or withdrawals, loans, payments, information like account balance and more.

Q) The term ‘Core Banking Solutions’ is sometimes seen in the news. Which of the following statements best describes/ describe this term?

1. It is a networking of a bank’s branches which enables customers to operate their accounts from any branch of the bank on its network regardless of where they open their accounts.

2. It is an effort to increase RBI’s control over commercial banks through computerization.

3. It is a detailed procedure by which a bank with huge non-performing assets is taken over by another bank.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1,2 and 3

Functions of Commercial Banks

Accepting deposits: The banks borrow in the form of deposits.

- Demand or Current account deposits: In this type of deposits the depositor can withdraw the money in part or in full at any time he likes without notice. These accounts are generally kept by the businessmen whose requirements of making business payments are quite uncertain. Usually, no interest is paid on them, because the bank cannot utilize these short term deposits and must keep almost cent percent reserve against them.

- Fixed deposits or Time deposits: These deposits are made for a fixed period of time, which varies from fifteen days to a few years. These deposits cannot, therefore, be withdrawn before the expiry of that period. However, a loan can be taken from the bank against the security of this deposit within that period. A higher rate of interest is paid on the fixed deposits based on the period of the deposits.

- Saving bank deposits: In this case the depositor can withdraw money usually once a week. These deposits are generally made by the people of small means, usually people with fixed salaries, for holding short-term savings. Like the current account deposits, the saving bank deposits are payable on demand and also they can be drawn upon through cheques.

Q) Consider the following liquid assets:

1. Demand deposits with the banks

2. Time deposits with the banks

3. Saving deposits with the banks

4. Currency

The correct sequence of these assets in the decreasing order of liquidity is

(a) 1-4-3-2

(b) 4-3-2-1

(c) 2-3-1-4

(d) 4-1-3-2

2. Advancing loans: One of the primary functions of the commercial bank is to advance loans to its customers. A bank lends a certain percentage of the cash lying in deposits on a higher interest rate than it pays on such deposits. Thus the bank earns profits and carries on its business.

The difference between the lending rate and savings rate is called interest margin.

Q) Why is the offering of “teaser loans” by commercial banks a cause of economic concern?

1. The teaser loans are considered to be an aspect of sub-prime lending and banks may be exposed to the risk of defaulters in future.

2. In India, the teaser loans are mostly given to inexperienced entrepreneurs to set up manufacturing or export units.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

3. Credit creation: Credit creation is one of the most important functions of the commercial banks. Like other financial institutions, they aim at earning profits. For this purpose, they accept deposits and advance loans by keeping a small amount of cash as reserve for day-to-day transactions.

When a bank advances a loan, it opens an account in the name of customer and does not pay him in cash but allows him to draw the money by cheque according to his needs. By granting a loan, the bank creates credit or deposit.

4. Financing Foreign Trade: A commercial bank finances foreign trade of its customers by accepting foreign bills of exchange and collecting them from foreign banks. It also transacts other foreign exchange business and sells foreign currency.

5. Investment: It is obligatory for commercial banks to invest a part of their funds in approved securities. Other optional avenues of investments are also available. Investments in government securities are useful in two ways. One is that, the commercial banks can get income from their surplus funds. The other is that the liquidity, that is, encash ability of securities is higher than that of loans.

6. Miscellaneous Services: Besides the above noted services, the commercial bank performs a number of other services. It acts as a custodian of the valuables of its customers by providing them lockers where they can keep their jewellery and valuable documents. It issues various forms of credit instruments, such as cheques, drafts, travellers’ cheques, etc. which facilitate transactions.

The bank also issues letters of credit and acts as a referee to its clients. It underwrites shares and debentures of companies and helps in the collection of funds from the public.

ATM stands for Automated Teller Machine. It is also depicted as Any Time Money as it provides the customers to withdraw money 24 hours subject to certain restrictions.

Q) Consider the following statements:

The functions of commercial banks in India include.

1. Purchase and sale of shares and securities on behalf of customers

2. Acting as executors and trustees of wills

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Q) In the context of the Indian economy, non-financial debt includes which of the following?

1. Housing loans owed by households

2. Amounts outstanding on credit cards

3. Treasury bills

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1,2 and 3

Different payment and settlement systems in India

India has made the task of transferring money from one bank account to another easier and faster. Now account holders don’t have to wait for days to receive money in their bank accounts. With the help of the latest digital payment systems, money can be sent and received in an instant anytime from anywhere.

A large number of banks, private companies and government bodies along with others are adopting different payment and settlement methods. This has helped in reducing the gap between the entities and their customers and other concerned people.

These methods are fast, convenient and useful for documentation purposes. They also are superior in terms of reliability and cost involved.

National Payments Corporation of India: The National Payments Corporation of India (NPCI) is an initiative taken by the Reserve Bank of India (RBI) and Indian Bank’s Association (IBA) to operate the retail payments and settlement systems in India.

This organisation was founded in the year 2008 under the Payment and Settlement Systems Act, 2007.

Major objective of NPCI was facilitating an affordable payment system that can help the common people during financial inclusion.

Brown Label ATMs: Brown Label ATMs are outsourcing firms whose services are implemented under contracts with specific banks. Hence the RBI is not directly involved in this.

They are operated by service providers who lease the ATM hardware, with cash management and connectivity to banking networks handled by a sponsor bank.

White Label ATMs: White Label ATMs need to acquire a licence and permission from the RBI to implement their services. Hence the RBI is directly involved in these.

The first White Label ATM in India is Indicash, established by Tata Communication Payment Solutions Limited.

Q) Which one of the following links all the ATMs in India?

(a) Indian banks’ Association

(b) National Securities Depository Limited

(c) National Payments Corporation of India

(d) Reserve Bank of India

Q) Consider the following statements:

1. National Payments Corporation of India (NPCI) helps in promoting the financial inclusion in the country.

2. NPCI has launched RuPay, a card payment scheme.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

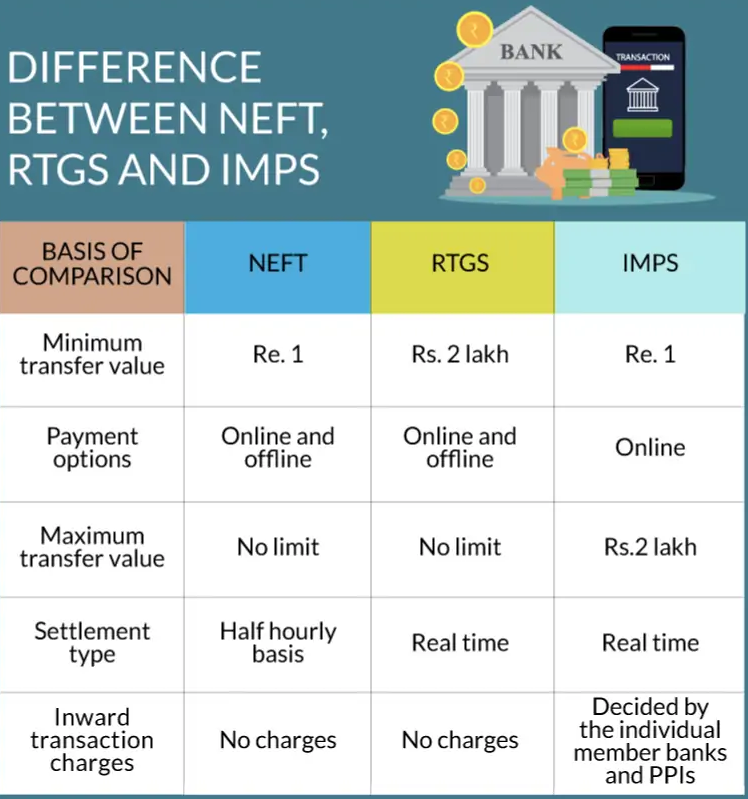

Different Ways to Transfer Funds Online in India India currently has various methods to transfer money online such as digital wallets, UPI, and more. However, the most commonly used online fund transfer method has been:

- National Electronic Funds Transfer (NEFT)

- Real Time Gross Settlement (RTGS)

- Immediate Mobile Payment Service (IMPS)

While NEFT and RTGS was introduced by RBI (Reserve Bank of India), IMPS was introduced by National Payments Corporation of India (NPCI).

NEFT: National Electronic Funds Transfer (NEFT) is a payment system that facilitates one-to-one funds transfer. Using NEFT, people can electronically transfer money from any bank branch to a person holding an account with any other bank branch, which is participating in the payment system. The NEFT transactions can be carried out in bulk and repetitively.

RTGS: Real Time Gross Settlement (RTGS) is another payment system in which the money is credited in the beneficiary’s account in real time. This fund transfer method is typically used to transfer enormous sum of money.

IMPS: IMPS is an abbreviation for Immediate Mobile Payment Services, which is an instant inter-bank funds transfer system. This funds transfer method is more customer-centric than the other two as it allows the remitter to transfer funds using their smartphones.

NEFT, RTGS and IMPS payment systems were introduced to offer convenience and flexibility to the account holders. To use these online fund transfer services, remitter (person who wants to transfer money) must have the basic bank account details of the beneficiary (person to whom the money is to be transferred).

The bank account details include the beneficiary’s name and bank’s IFSC(Indian Financial System Code). Though all the three payment systems are used for funds transfer, they exhibit a few differences. Before learning their differences, let’s first learn some basic terms revolving around payment systems. These terms will help in understanding the difference among different payment systems better.

Q) Which one of the following best describes the term “Merchant Discount Rate” sometimes seen in news?

(a) The incentive given by a bank to a merchant for accepting payments through debit cards pertaining to that bank.

(b) The amount paid back by banks to their customers when they use debit cards for financial transactions for purchasing goods or services.

(c) The charge to a merchant by a bank for accepting payments from his customers through the bank’s debit cards.

(d) The incentive given by the Government, to merchants for promoting digital payments by their customers through Point of Sale (PoS) machines and debit cards.

Fund Transfer Limit

The maximum and minimum amount of money allowed for transfer by each payment system may differ.

Service Availability

Some payment systems are available for 24*7 while others have specific timings. Payment systems that are available 24*7 allow remitters to initiate money transfer anytime and any day. However, the funds will settle only when the service is available.

Fund Settlement Speed

Different fund payment systems have different fund settlement speed. Fund settlement speed here is the total time consumed to settle money from one account to another after the transfer has been initiated.

Fund Transfer Charges

Transferring money involves charges. As per RBI, fund transfer charges for each payment system are decided by banks. The amount charged is based on the amount to be transferred, transfer speed and other features offered by the bank.

UPI and BHIM

Q) Which of the following is a most likely consequence of implementing the ‘Unified Payments interface (UPI)”?

(a) Mobile wallets will not be necessary for online payments.

(b) Digital currency will totally replace the physical currency in about two decades.

(c) FDI inflows will drastically increase.

(d) Direct transfer of subsidies to poor people will become very effective.

Q) With reference to digital payments, consider the following statements:

1. BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

2. While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither I nor 2

Escrow Account: An escrow account is a temporary pass through account held by a third party during the process of a transaction between two parties. This is a temporary account as it operates until the completion of a transaction process, which is implemented after all the conditions between the buyer and the seller are settled.

Escrow account is very useful in the case of a transaction where a large amount money is involved and a certain number of requirements need to be fulfilled before a payment is released like in the case of marketplace model where the buyer might want confirmation of the quality of product being done before making a payment, and the seller doesn’t want to extend a work without any assurance that he or she will receive payment

Vostro Account: A vostro account is an account a correspondent bank holds on behalf of another bank. These accounts are an essential aspect of correspondent banking in which the bank holding the funds acts as custodian for or manages the account of a foreign counterpart. For example, local currency account maintained by a local bank for a foreign (correspondent) bank. For the foreign bank it is a nostro account.

Nostro Account: Nostro accounts are generally held in a foreign country (with a foreign bank), by a domestic bank (from our perspective, our bank). It obviates that account is maintained in that foreign currency. For example, SBI account with HSBC in U.K.

SWIFT:

- Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a member-owned cooperative that provides safe and secure financial transactions for its members.

- This payment network allows individuals and businesses to take electronic or card payments even if the customer or vendor uses a different bank than the payee.

- SWIFT works by assigning each member institution a unique ID code that identifies not only the bank name but the country, city, and branch.

NRE/NRO Account: An NRE account is a Non-Resident Rupee Account with the complete repatriability of both principal and interest amount. Repatriability means the ability of an asset (here principal and the interest amount) to be moved back from a foreign country to the home country of the investor.

An NRO account is a Non-Resident Ordinary Rupee Account with the repatriability of up to USD 1 million on both principal and interest amount per financial year

FCNR: FCNR deposits stands for Foreign Currency Non-Repatriable account deposits. This is a Fixed Deposit Foreign Currency account and not a savings account. Deposits in this account can be made in any of the major currencies like US Dollar, UK Pound, Canadian Dollar, Deutsche Mark, Japanese Yen and Euro.

Q) As part of the liberalisation programme and with a view to attract foreign exchange, the government and the RBI have, devised two scheme known as FCNR [A] Scheme and FCNR [B] Scheme.

Which of the following is/are true regarding these two schemes?

1. Under scheme ‘A’ RBI bears exchange rate fluctuations.

2. Under scheme ‘B’ other banks are to meet out the difference in exchange rate fluctuations.

3. Both the schemes stand withdrawn now.

4. Only scheme ‘A’ has been withdrawn

Codes:

(a) 3 only

(b) 1 and 2

(c) 1,2 and 3

(d) 1,2 and 4

RFCA: The Resident Foreign Currency (RFC) accounts are opened with an authorised dealer in India to maintain funds earned in a foreign currency. These can be in the form of savings, current or term deposit accounts.

Q) With reference to the institution of Banking Ombudsman in, India, which one of the statements is not correct?

(a) The Banking Ombudsman is appointed by the Reserve Bank of India.

(b) The Banking Ombudsman can, consider complaints from Non-Resident Indians having accounts in India.

(c) The orders passed by the Banking Ombudsman are final and binding on the parties concerned.

(d) The service provided by the Banking Ombudsman is free of any fee.

Financial Inclusion:

Is the delivery of financial services at affordable costs to sections of disadvantaged and low-income segments of society, in contrast to financial exclusion where those services are not available or affordable.

It refers to all types of financial services, including savings, payments and credit from all types of formal financial institutions. It strives to address and bring solutions to the constraints that exclude people from participating in the financial sector.

Need for Financial inclusion:

- Helps in creating a platform for inculcating the habit to save money.

- Provides formal credit avenues.

- Plug gaps and leaks in public subsidies and welfare programmes.

- For credit availability

- For boosting savings

- Reduce leak in subsidy and welfare distribution.

- The 11th Five Year Plan (2007-12) highlighted that significant segment of the India’s population had been excluded from the growth over the past decade and called financial inclusion a top priority.

- The facts reflect that out of 600,000 villages in the country, only about 30,000 have a commercial bank branch.

- Till recently, more than 50% of India’s population did not have any bank account and more than half of the total farmer households did not seek credit from either institutional or non-institutional sources of any kind

Government initiatives for financial inclusion in India:

- The Government recently announced ”Pradhan Mantri Jan Dhan Yojana”, a national financial inclusion mission which aims to provide bank accounts to at least 75 million people.

- Several Start-ups are also working towards increasing financial inclusion in India.

- The government also came up with a policy under the name ”rupee exchange” to exchange higher notes with the intent of clamping down on tax defaulters, track down corrupt officers and restoring sanity to the economic system.

- Mandating banks to lend to small-scale industries, agriculture sector and to small borrowers.

- Opening of bank branches in rural areas.

- Introduction of Lead Bank Scheme; the 20- Point Economic Programme and

- The Integrated Rural Development Programme.

Q) With reference to India, consider the following:

1. Nationalization of Banks

2. Formation of Regional Rural Banks

3. Adoption of villages by Bank Branches

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1,2 and 3

Q) In the context of independent India’s economy, which one of the following was the earliest event to take place?

(a) Nationalization of Insurance companies

(b) Nationalization of State Bank of India

(c) Enactment of Banking Regulation Act

(d) Introduction of First Five-Year Plan

Steps taken by RBI:

- In India, RBI has initiated several measures to achieve greater financial inclusion such as facilitating no-frill accounts and GCC’s for small deposits and credit.

- Relaxation on know-your-customer (KYC) norms, thereby simplifying procedure by stipulating that introduction by an account holder who has been subjected to the full KYC drill would suffice for opening such accounts.

- Engaging business correspondents (BCs), as intermediaries for providing financial and banking services.

- Recognizing that technology has the potential to address the issue of outreach and credit delivery in rural and remote areas.

- GCC, for helping the poor and disadvantaged with access to easy credit, banks have been asked to consider introduction of a general purpose credit card facility up to 25000 at their rural and semi-rural branches. The objective of this scheme is to provide hassle-free credit to bank’s customers.

- Simplified branch authorization to address the issue of uneven spread of bank branches.

- Opening of branches in unbanked rural centres to further step up the opening of branches in rural areas so as to improve banking penetration and financial inclusion rapidly.

- EBT-Electronic Benefits Transfer, to plug the leakages that are present in transfer of payments through the various levels of bureaucracy, government has begun the procedure of transferring payment directly to accounts of the beneficiaries.

Q) What is/are the facility/facilities the beneficiaries can get from the services of Business Correspondent (Bank Saathi) in branchless areas?

1. It enables the beneficiaries to draw their subsidies and social security benefits in their villages.

2. It enables the beneficiaries in the rural areas to make deposits and withdrawals.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Microfinance in India:

Microfinance refers to providing financial services, including small-value loans, to households, small businesses, and entrepreneurs who lack access to formal banking services.

Business Models in Microfinance:

Self-Help Groups (SHGs):

SHGs are informal groups of 10–20 members, mainly women, who pool their savings and become eligible for credit from formal banking institutions under the SHG-Bank Linkage Programme (SHG-BLP). NABARD plays a key role in developing and supporting SHGs.

Microfinance Institutions (MFIs):

MFIs provide micro-credit and other financial services like savings, insurance, and remittances. Loans are typically provided through Joint Lending Groups (JLGs), informal groups of 4–10 members engaged in similar economic activities who jointly repay loans.

Measures to promote Microfinance Institutions (MFIs)

Indian Micro Finance Equity Fund (IMEF): To address liquidity challenges, the Government of India introduced the Indian Micro Finance Equity Fund (IMEF).

Operated through the Small Industries Development Bank of India (SIDBI), this fund was aimed at strengthening the capitalization of smaller, socially oriented MFIs, particularly in underserved areas.

Role of NABARD: NABARD’s Micro Credit Innovations Department facilitates access to financial services for the unreached poor in rural areas through various microfinance innovations.

Self Help Group – Bank Linkage Programme (SHG-BLP): SHG-BLP is a cost-effective model linking poor households to formal financial institutions.

NABARD Financial Services Ltd. (NABFINS): NABARD established NABFINS as a model microfinance institution, focusing on governance, transparency, and reasonable interest rates.

Micro Enterprise Development Programmes (MEDPs): Skill training for SHG members to enhance production activities.

E-Shakti Initiative: The E-Shakti initiative, launched by NABARD, is a major technological advancement for the microfinance sector. The project focuses on mapping existing Self Help Groups (SHGs) and uploading both financial and non-financial information on a dedicated website.

This digitization of SHGs improves transparency, enables better access to data, and facilitates more efficient financial inclusion efforts.

Pradhan Mantri MUDRA Yojana (PMMY): Launched in 2015, the Pradhan Mantri MUDRA Yojana (PMMY) was introduced to enhance credit flow to small businesses, an essential component of financial inclusion.

Q) Microfinance is the provision of financial services to people of low-income groups. This includes both the consumers and the self-employed. The service/services rendered under microfinance is/are:

1. Credit facilities

2. Savings facilities.

3. Insurance facilities

4. Fund Transfer facilities

Select the correct answer using the codes given below the lists?

(a) 1 only

(b) 1 and 4 only

(c) 2 and 3 only

(d) 1,2,3 and 4

Issues and challenges:

Amidst the signs of progress, the Indian Banking sector has been facing multiple challenges in recent times. Few of them are –

1. Reduced Profits: The banking sector recorded slowdown in balance sheet growth for the fourth year in a row in 2015-16. Profitability remained depressed with the return on assets (RoA) continuing to linger below 1 percent. Further, though PSBs account for 72 percent of the total banking sector assets, in terms of profits it has only 42 percent share in overall profits.

Priority Sector Lending

Priority Sector Lending (PSL as it called popularly) is way to provide higher priority to certain economic sectors in our country.

What Priority?

Giving them better access to credit/loans as usually these sectors may not automatically be attractive for banks to lend in comparison to other opportunities available to bank for deploying the money with them.

Which sectors get priority and why?

These sectors are listed out by the RBI in consultation with the central government based on the ongoing government priorities. The idea is that these sectors are critical to country’s economy and for people’s upliftment in the country. for e.g. Agriculture, MSMEs since they give employment for more people, Microfinance, Education as it helps in skill improvement of people, Housing up to certain amount as it provides shelter to the needy, Renewable energy as it may help Indian become less dependent on fossil fuels etc.

Q) Priority Sector Lending by banks in India constitutes the lending to

(a) Agriculture

(b) Micro and small enterprises

(c) Weaker sections

(d) All of the above

How much priority?

Each bank when it crosses certain size is required to keep aside and deploy 40% of total credit/loans it gives towards PSL. This ensures Banks are also on lookout of giving loans to the borrowers from such sectors. If the Banks miss out on meeting the PSL targets, the banks get penalized by the RBI.

Q) The farmers are provided credit from a number of sources for their short and long term needs. The main sources of credit to the farmers include:

(a) The Primary Agricultural Cooperative Societies, commercial banks, RRBs and private money lenders

(b) The NABARD, RBI, commercial banks and private money lenders

(c) The District Central Cooperative Banks (DCCB), the lead banks, IRDP and JRY

(d) The Large Scale Multi-purpose Adivasis Programme, DCCB, IFFCO and commercial banks

Q) In India, which of the following have the highest share in the disbursement of credit to agriculture and allied activities?

(a) Commercial Banks

(b) Cooperative Banks

(c) Regional Rural Banks

(d) Microfinance Institutions

Differential Rate of Interest Scheme

Differential Rate of Interest Scheme introduced to provide bank finance at a concessional rate of interest of 4 per cent p.a.(per annum) to the weaker sections of the community for engaging in productive and gainful activities so that they could improve their economic conditions.

The scheme was introduced in 1972 and is being implemented by all-Indian Scheduled Commercial Banks. The scheme is being implemented throughout the country.

Lead Bank Scheme

The Lead Bank Scheme, introduced towards the end of 1969, envisages assignment of lead roles to individual banks (both in public sector and private sector) for the districts allotted to them.

A bank having a relatively large network of branches in the rural areas of a given district and endowed with adequate financial and manpower resources has generally been entrusted with the lead responsibility for that district.

Accordingly, all the districts in the country have been allotted to various banks. The lead bank acts as a leader for coordinating the efforts of all credit institutions in the allotted districts to increase the flow of credit to agriculture, small-scale industries and other economic activities included in the priority sector in the rural and semi-urban areas, with the district being the basic unit in terms of geographical area.

Q) The basic aim of Lead Bank Scheme is that

(a) Big banks should try to open offices in each district

(b) There should be stiff competition among the various nationalized banks

(c) Individual banks should adopt particular districts for intensive development

(d) All the banks should make intensive efforts to mobilize deposits.

Q) The Service Area Approach was implemented under the purview of

(a) Integrated Rural Development Programme

(b) Lead Bank Scheme

(c) Mahatma Gandhi National Rural Employment Guarantee Scheme

(d) National Skill Development Mission

Jan Dhan Yojana

PMJDY is a nationwide scheme launched by the Government of India to ensure financial inclusion of every individual who does not have a bank account in India. This scheme aims at providing access to financial services, namely, Banking / Savings & Deposit Accounts, Remittance, Credit, Insurance, and Pension in an affordable manner to all.

This scheme was launched in August 2014 and according to reports by the Ministry of Finance, around 4 crore bank accounts have been opened under this scheme till September 2014.

An individual can consider opening an account under this scheme with any bank branch or Business Correspondent (Bank Mitr) outlet. Further, accounts opened under PMJDY can be opened with Zero balance.

However, if the account- holder wishes to get a cheque book, he/she will have to fulfil minimum balance criteria. The account holders under this scheme will be given a RuPay debit card which can be used across all ATMs for cash withdrawal.

Q) ‘Pradhan Mantri Jan-Dhan Yojana’ has been launched for

(a) Providing housing loan to poor people at cheaper interest rates

(b) Promoting women’s Self-Help Groups in backward areas

(c) Promoting financial inclusion in the country

(d) Providing financial help to the marginalized communities

The benefits of the PMJDY Scheme:

Insurance Benefits

The account holders under this scheme will get an accidental insurance cover of Rs 1 lakh and a life cover of Rs 30,000 – payment on the death of the beneficiary (subject to conditions).

Loan Benefits

The account holders under this scheme can avail an overdraft facility up to Rs 5,000. This is available against one account per household. The quantum of the loan may look small but definitely is a boon to those below the poverty line and would enable them to reinvest this in more profitable avenues.

Mobile Banking Facility:

Enabling carrying out transactions through a mobile phone facilitates such account holders in checking of balance and also transferring funds with ease across India.

- The other benefits being:

- The account holders would be eligible for interest on their deposits

- They are not mandated to have a minimum balance in the account

- The scheme allows Direct Benefit Transfer for beneficiaries of Government Schemes.

- Account-holders can get easy access to pension and other insurance products with the PMJDY scheme.

-

Non-Performing Assets (NPAs)

A non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days. These are the assets of the banks which don’t bring any return. However, in terms of Agriculture / Farm Loans; the NPA is defined as under:

- For short duration crop agriculture loans such as paddy, Jowar, Bajra etc. if the loan (instalment / interest) is not paid for 2 crop seasons , it would be termed as a NPA.

- For Long Duration Crops, the above would be 1 Crop season from the due date.

Standard Asset: If the borrower regularly pays his dues regularly and on time; bank will call such loan as its “Standard Asset”. A secured loan, is a loan in which the borrower pledges some asset (e.g. a car or property) as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan. An unsecured loan is one that is obtained without the use of property as collateral for the loan, and it is also called a signature loan or a personal loan.

Provisioning: For every loan given out, the banks to keep aside some extra funds to cover up losses if something goes wrong with those loans.

Classification of NPAs

- If the borrower does not pay dues for 90 days after end of a quarter; the loan becomes an NPA and it is termed as “Special Mention Account”. If this loan remains SMA for a period less than or equal to 12 months; it is termed as Sub-standard Asset. In this case, bank has to make provisioning as follows:

- 15% of outstanding amount in case of Secured loans

- 25% of outstanding amount in case of Unsecured loans

- If sub-standard asset remains so for a period of 12 more months; it would be termed as “Doubtful asset”. This remains so till end of 3rd year. In this case, the bank need to make provisioning as follows:

- Up to one year: 25% of outstanding amount in case of Secured loans; 100% of outstanding amount in case of Unsecured loans

- 1-3 years: 40% of outstanding amount in case of Secured loans; 100% of outstanding amount in case of Unsecured loans

- more than 3 years: 100% of outstanding amount in case of Secured loans; 100% of outstanding amount in case of Unsecured loans.

- If the loan is not repaid even after it remains sub-standard asset for more than 3 years, it may be identified as unrecoverable by internal / external audit and it would be called loss asset. An NPA can declared loss only if it has been identified to be so by internal or external auditors.

Gross NPA is the amount which is outstanding in the books, regardless of any interest recorded and debited. Net NPA is Gross NPA less interest debited to borrower account and not recovered or recognized as income.

Reasons for Growth of NPAs

- Due diligence not done in initial disbursement of loans. Eg: loans given to road sector even before acquisition of land by the contractors.

- Inefficiencies in post disbursement monitoring of the problem

- Diversion of funds by companies for purposes other than for which loans were taken

- Restructuring of loans done by banks earlier to avoid provisioning. Post crackdown by RBI, banks are forced to clear their asset books which has led to sudden spurt in NPAs

- Economic downturn seen since 2008

- Global demand is still low due to which exports across all sector has shown a declining trend for a long while now

- Economic Survey 2015 mentioned over leveraging by corporate as one of the reasons behind rising bad loans

- Policy Paralysis seen during UPA 2 regime affected several PPP projects and key economic decisions were delayed which affected the macroeconomic stability leading to poorer corporate performance

- Crony capitalism is also to be blamed. Under political pressure banks are compelled to provide loans for certain sectors which are mostly stressed

- In the absence of a proper bankruptcy law, corporate faced exit barriers which led to piling up of bad loans

Impact of NPAs

- Banks have to adhere to the provisioning norms set by RBI for the bad loans which eats into their profitability. This leads to banks having lesser capital to deploy, shareholders losing money and banks finding it tough to survive in the market.

- Rising of NPAs will lead to a crisis of confidence in the market. The price of loans, i.e. the interest rates will shoot up. Shooting of interest rates will directly impact the investors who wish to take loans for setting up infrastructural, industrial projects etc.

- If banks do not classify an asset as NPA, they naturally have more money to advance to earn interest income on. If large NPAs goes unreported, the bank could reach a situation, where it has advanced more money than it has available leading to a situation of technical bankruptcy.

- It will also impact the retail consumers like us, who will have to shell out a higher interest rate for a loan. This will hurt the overall demand in the Indian economy which will lead to lower growth rates and of course higher inflation because of the higher cost of capital. The trend may continue in a vicious circle and deepen the crisis.

- In light of attaining the Basel norms, the burden on maintaining Capital Adequacy Ratio increases.

- For economy, NPAs are disadvantageous as banks become more circumspect in giving loans which affect the credit offtake in economy. India is still an economy which is largely dependent on banks to raise capital as the bond market is not that well developed. This leads to declining Gross Capital Formation affecting economic growth.

- Corruption: Scams in the erstwhile Global Trust Bank (GBT) and the Bank of Baroda show how few officials misuse the freedom they granted under the guise of liberalization for their personal benefit. These scams have badly damaged the image of these banks and consequently their profitability.

- Crisis in Management: Public sector banks are seeing more employees retire these days. So, younger employees are replacing the elder, more-experienced employees. This however, happens at junior levels. As a result, there would be a virtual vacuum at the middle and senior level. The absence of middle management could lead to adverse impact on banks decision making process.

- Issue of Monetary Transmission: Monetary transmission refers to the process by which a central bank’s monetary policy signals (like repo rate) are passed on, through financial system to influence the businesses and households.

There are many monetary policy signals by the RBI; the most powerful one is the repo rate. When repo rate is changed, it brings changes in the overall interest rate in the economy as well. As a result of a decrease in repo rate, the interest rate on loans by banks also changes and this encourages consumption and investment activities of businesses and households.

Reasons for problems in monetary transmission:

Banks can raise lending rates faster after a policy rate hike because loans are mostly at variable rates and can be re-priced faster. However, keeping pace with a policy rate cut is unpalatable for commercial banks.

That’s because the cost of deposits can’t be reduced in the short term, they carrying a fixed rate of interest. Also, with competition from small savings instruments, it is difficult to cut rates it offers depositors.

The banking system continues to be under stress due to rising non-performing assets (NPAs), which along with restructured assets are estimated at about 10 per cent of total assets currently.

Lack of demand for credit: The demand for credit from corporates also remain low, due to balance sheet concerns, difficulty in acquiring land for fresh green-field projects, low capacity utilisation and lower working capital loan requirement, helped by falling global oil prices.

Tight liquidity condition: Commercial banks have to maintain four per cent CRR with RBI, on which they do not earn any interest. A meaningful cut in the CRR will not only help inject additional liquidity into the system, thereby freeing resources to lend, but also help banks to pass on rate cuts without taking a hit on their net interest margin.

To address the Monetary Transmission problem in these circumstances RBI had devised new formula to calculate the Base Rate using the Marginal Cost of Funds based Lending rate (MCLR). Previously also banks were calculating base rate using a formula, but that formula does not take marginal cost of funds into consideration.

To differentiate the change clearly now look into both the formulas:

What is Base Rate?

Base rate is the minimum interest rate at which commercial banks can lend money to customers. For instance, currently SBI’s base rate is 9.75%. This means that the bank can’t lend at a rate below 9.75%. Base rate mainly includes three things: cost of fund, unallocated cost of resources and return on net worth.

The ratio of these three elements vary from bank to bank. Banks alter the base rate whenever their cost of funds and other parameters alter, depending on change in key rates. Introduced by Reserve Bank of India (RBI), it came into existence on 1 July 2010.

Banks normally lend at base rate plus margin. So even if the base rate remains the same, but the margin changes, the interest rate would be altered. But this will affect only new borrowers.

What is BPLR?

Benchmark prime lending rate (BPLR) was used as the benchmark rate before the base rate was introduced. The BPLR is the rate that commercial banks used to charge from premium customers. BPLR still exists in banks, but only on loans that were taken before base rate came into effect. Controversy: When base rate didn’t exist, banks used BPLR.

However, RBI felt that banks were misusing it by lending money at rates lower than BPLR to privileged customers, while passing on the cost to retail borrowers who lacked the negotiation power. The system was totally opaque.

For instance, when interest rates declined, only new customers were offered the lower rate, while the old borrower continued to pay a higher rate of interest. This kind of discrimination can’t happen under the base rate regime because no lending can happen below the base rate.

What it means for you?

If you are on base rate, your equated monthly instalment (EMI) will change with any change in the base rate. If you took a loan before the base rate came into existence and are still on BPLR, it would be better to get your loan linked to the base rate.

The base rate is normally lower than BPLR. This is because the elements used in defining base rate are based on costs, whereas elements used to define BPLR are based on profits. Also, the base rate is more transparent.

Indian Banking system has passed various phases of change marking its development. Interest rate on lending product is one of the major sources of revenue.

As per Narasimhan committee Report on banking reform, banks should be given authority to price the lending product. It aimed at enhancing the profitability and efficiency of banking system. It also aims at developing an efficient channel of monetary policy transmission. Lending rate in India has passed through various stages starting from BPLR to Base rate, now new form of base rate.

Old Base Rate:

The base rate or the standard lending rate by a bank is calculated on the basis of the following factors:

- Cost for the funds (interest rate given for deposits),

- Operating expenses,

- Minimum rate of return (profit), and

- Cost for the CRR (for the four percent CRR, the RBI is not giving any interest to the banks)

Marginal Cost of Funds based Lending Rate (MCLR)

As per the new guidelines by the RBI, banks have to prepare Marginal Cost of Funds based Lending Rate (MCLR) which will be the internal benchmark lending rates.

The MCLR should be revised monthly by considering some new factors including the repo rate and other borrowing rates. Now, banks have to set five benchmark rates for different tenure or time periods ranging from overnight (one day) rates to one year.

How to calculate MCLR

The concept of marginal is important to understand MCLR. In economics sense, marginal means the additional or changed situation. While calculating the lending rate, banks have to consider the changed cost conditions or the marginal cost conditions.

For banks, what are the costs for obtaining funds? It is basically the interest rate given to the depositors (often referred as cost for the funds). The MCLR norm describes different components of marginal costs. A novel factor is the inclusion of interest rate given to the RBI for getting short term funds – the repo rate in the calculation of lending rate.

Main components of MCLR:

- Marginal cost of funds: The marginal cost that is the novel element of the MCLR. The marginal cost of funds will comprise of Marginal cost of borrowings and return on net-worth. According to the RBI, the Marginal Cost should be charged on the basis of following factors:

- Interest rate given for various types of deposits- savings, current, term deposit, foreign currency deposit

- Borrowings – Short term interest rate or the Repo rate etc., Long term rupee borrowing rate.

- Negative carry on account of CRR: It is the cost that the banks have to incur while keeping reserves with the RBI. The RBI is not giving an interest for CRR held by the banks. The cost of such funds kept idle can be charged from loans given to the people.

- Operating cost: It is the operating expenses incurred by the banks

- Tenor premium: Denotes that higher interest can be charged from long term loans.

Return on net worth – in accordance with capital adequacy norms, the marginal cost of borrowings shall have a weightage of 92% of Marginal Cost of Funds while return on net worth will have the balance weightage of 8%.

According to the RBI guideline, actual lending rates will be determined by adding the components of spread to the MCLR. Spread means that banks can charge higher interest rate depending upon the riskiness of the borrower.

Q) What is/are the purpose/purposes of the ‘Marginal Cost of Funds based Lending Rate (MCLR)’ announced by RBI?

1. These guidelines help improve the transparency in the methodology followed by banks for determining the interest rates on advances.

2. These guidelines help ensure availability of bank credit at interest rates which are fair to the borrowers as well as the banks.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

How different MCLR from Base rate:

- Costs that the bank is incurring to get funds (means deposit) is calculated on a marginal basis.

- The marginal costs include Repo rate; whereas this was not included under the base rate.

- Many other interest rates usually incurred by banks when mobilizing funds also to be carefully considered by banks when calculating the costs.

- The MCLR should be revised monthly.

- A tenor premium or higher interest rate for long term loans should be included.

In a floating rate loan, the rate of interest is ‘floating’ because it is not fixed; it varies over the life of the loan (In fixed rate the interest rate will not change). There is a benchmark, which is the reference point for determining the rate, and there is a spread, which is the additional component that you have to pay over the benchmark.

For example, if the benchmark is the bank’s Marginal Cost of Funds-based Lending Rate (MCLR), then the MCLR plus spread is the rate of interest to be paid. Let’s understand what an internal benchmark is and what an external benchmark is.

Something which is determined by the bank or is influenced by the bank, e.g. Benchmark Prime Lending Rate (BPLR), or MCLR, is internal. Something over which the bank does not have any control or influence is external. The SDRP mentions the external benchmarks as:

- Reserve Bank of India policy repo rate, or

- Government of India 91-days or 182-days Treasury Bill yield produced by the Financial Benchmarks India Private Ltd (FBIL), or

- Any other benchmark market interest rate produced by the FBIL

Internal Vs External Benchmarking

Initiatives taken for containing NPAs & Various Acts and Policies to tackle NPAs

SARFAESI Act (The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002) was enacted to regulate securitization and reconstruction of financial assets and enforcement of security interest created in respect of Financial Assets to enable realization of such assets.

SARFAESI is effective only for secured loans where bank can enforce the underlying security eg hypothecation, pledge and mortgages. In such cases, court intervention is not necessary, unless the security is invalid or fraudulent. However, if the asset in question is an unsecured asset, the bank would have to move the court to file civil case against the defaulters.

Recovery of Debts Due to Banks and Financial Institutions (DRT) Act: The Act provides setting up of Debt Recovery Tribunals (DRTs) and Debt Recovery Appellate Tribunals (DRATs) for expeditious and exclusive disposal of suits filed by banks / FIs for recovery of their dues in NPA accounts with outstanding amount of Rs. 10 lac and above.

Joint Lenders Forum: The Joint Lender’s Forum is a dedicated grouping of lender banks that is formed to speed up decisions when an asset (loan) of more Rs 100 crore or more turns out to be a stressed asset.

RBI has issued guidelines for the formation of JLF in 2014 for the effective management of stressed assets. Instructions for the formation of JLF is mentioned in the RBI guideline titled ‘Framework for Revitalizing Distressed Economy’ (2014).

The JLF has to initiate Corrective Actions when an account becomes the potential of being an NPA. As per the present norm, the JLF can take steps when an account with a size of More than Rs 100 crores or more doesn’t return payments and becomes a special mention account.

Strategic Debt Restructuring Scheme(SDR):

This scheme provides for an alternative to restructuring. Wherever restructuring has not helped, banks can convert existing loans into equity.

The scheme provides for creation of Joint Lenders Forum which is to be given additional powers with respect to Management change in company getting restructured.

Sale of non-core assets in case company has diversified into sectors other than for which loans were guaranteed. Decision by JLF on debt restructuring by a majority of 75% by value and 60% by number.

Scheme for sustainable structuring of stressed assets(S4A) – This allows banks to split the stressed account into two heads – a sustainable portion that the bank deems that the borrower can pay on existing terms and the remaining portion that the borrower is unable to pay(unsustainable).

The latter can be converted into equity or convertible debt giving lenders a chance to eventually recover funds if the borrower is unable to pay.

The Scheme will help those projects which have started commercial operations and have outstanding loan of over Rs 500crore.

Difference between SDR Scheme and S4A scheme

Under the S4A Scheme, banks would be to allow existing promoter to continue in the management even while being a minority shareholder. Whereas in the case of SDR, the promoter is delinked and ownership is changed. Similarly, under the S4A Scheme, the lenders also have an option of holding optionally convertible debentures instead of equity, which might be more preferred option. But in the case of SDR only equity holding is allowed.

One possible strategy would be to create a ‘Public Sector Asset Rehabilitation Agency’ (PARA), charged with working out the largest and most complex cases. Such an approach could eliminate most of the obstacles currently plaguing loan resolution.

- It could solve the coordination problem, since debts would be centralized in one agency;

- It could be set up with proper incentives by giving it an explicit mandate to maximize recoveries within a defined time period; and

III. It would separate the loan resolution process from concerns about bank capital.

How would a PARA actually work? There are many possible variants, but the broad outlines are clear. It would purchase specified loans (for example, those belonging to large, over-indebted infrastructure and steel firms) from banks and then work them out, either by converting debt to equity and selling the stakes in auctions or by granting debt reduction, depending on professional of the value-maximizing strategy.

Once the loans are off the books of the public sector banks, the government would recapitalize them, thereby restoring them to financial health and allowing them to shift their resources – financial and human –back toward the critical task of making new loans.

Similarly, once the financial viability of the over-indebted enterprises is restored, they will be able to focus on their operations, rather than their finances. And they will finally be able to consider new investments.

Of course, all of this will come at a price, namely accepting and paying for the losses. But this cost is inevitable. Loans have already been made, losses have already occurred, and because public sector banks are the major creditors, the bulk of the burden will necessarily fall on the government (though the shareholders in the stressed enterprises may need to lose their equity as well).

In other words, the issue for any resolution strategy –PARA or decentralized — is not whether the government should assume any new liability. Rather, it is how to minimize the existing liability by resolving the bad loan problem as quickly and effectively as possible. And that is precisely what creation of the PARA would aim to do.

The 5/25 Refinancing of Infrastructure Scheme: This scheme offered a larger window for revival of stressed assets in the infrastructure sectors and eight core industry sectors.

Under this scheme lenders were allowed to extend amortisation periods to 25 years with interest rates adjusted every 5 years, so as to match the funding period with the long gestation and productive life of these projects.

The scheme thus aimed to improve the credit profile and liquidity position of borrowers, while allowing banks to treat these loans as standard in their balance sheets, reducing provisioning costs.

However, with amortisation spread out over a longer period, this arrangement also meant that the companies faced a higher interest burden, which they found difficult to repay, forcing banks to extend additional loans (‘evergreening’). This in turn has aggravated the initial problem.

Private Asset Reconstruction Companies (ARCs):

ARCs were introduced to India under the SARFAESI Act (2002), with the notion that as specialists in the task of resolving problem loans, they could relieve banks of this burden.

However, ARCs have found it difficult to resolve the assets they have purchased, so they are only willing to purchase loans at low prices. As a result, banks have been unwilling to sell them loans on a large scale.

Then, in 2014 the fee structure of the ARCs was modified, requiring ARCs to pay a greater proportion of the purchase price up-front in cash. Since then, sales have slowed to a trickle: only about 5 percent of total NPAs at book value were sold over 2014-15 and 2015-16.

Asset Quality Review (AQR): Resolution of the problem of bad assets requires sound recognition of such assets. Therefore, the RBI emphasized AQR, to verify that banks were assessing loans in line with RBI loan classification rules. Any deviations from such rules were to be rectified by March 2016.

Loss recognition: The AQR was meant to force banks to recognise the true state of their balance sheets. But banks nonetheless continue to evergreen loans, as the substantial estimates of unrecognised stressed assets make clear.

Coordination: The RBI has encouraged creditors to come together in Joint Lenders Forums, where decisions can be taken by 75 percent of creditors by value and 60 percent by number. But reaching agreement in these Forums has proved difficult, because different banks have different degrees of credit exposure, capital cushions, and incentives.

For example, banks with relatively large exposures may be much more reluctant to accept losses. In some cases the firm’s losses aren’t even known, for they depend on the extent of government compensation for its own implementation shortfalls, such as delays in acquiring land or adjusting electricity tariffs. And deciding compensation is a difficult and time-consuming task; many cases are now with the judiciary.

Proper incentives: The S4A scheme recognises that large debt reductions will be needed to restore viability in many cases. But public sector bankers are reluctant to grant write-downs, because there are no rewards for doing so. To the contrary, there is an inherent threat of punishment, since major write downs can attract the attention of investigative agencies. Accordingly, bankers have every incentive to simply reschedule loans, in order to defer the problems until a later date. To address this problem, the Bank Board Bureau (BBB) has created an Oversight Committee which can vet and certify write-down proposals. But it remains open whether it can change bankers’ incentives.

Sustainable Structuring of Stressed Assets (S4A): Under this arrangement, introduced in June 2016, an independent agency hired by the banks will decide on how much of the stressed of a company is ‘sustainable’. The rest (‘unsustainable’) will be converted into equity and preference shares. Unlike the SDR arrangement, this involves no change in the ownership of the company.

Mission Indradhanush

Mission Indradhanush is a 7 pronged plan launched by Government of India to resolve issues faced by Public Sector banks. It aims to revamp their functioning to enable them to compete with Private Sector banks.

Q) ‘Mission Indradhanush’ launched by the Government of India pertains to

(a) Immunization of children and pregnant women

(b) Construction of smart cities across the country

(c) India’s own search for the Earth-like planets in outer space

(d) New Educational Policy

Problems Faced by Indian Banks:

According to Economic Survey 2015, Indian banks face problems on both the policy and structural sides.

Policy issues– Banks face what has been termed as ‘double financial repression’- issues with policies of Statuary Liquidity Ratio and Private Sector Lending policies

Structural issues– Governance issues, rising stressed assets (Non- Performing Assets) and lack of diverse funding sources for infrastructure.

Components of Mission Indradhanush

Mission Indradhanush is a 7-pronged plan to address the challenges faced by public sector banks (PSBs). Many of the measures taken were suggested by P J Nayak committee on Banking sector reforms as indicated.

The 7 parts include appointments, Banks board bureau, capitalisation, de-stressing, empowerment, framework of accountability and governance reforms (ABCDEFG)

- Appointments – separation of posts of CEO and MD to check excess concentration of power and smoothen the functioning of banks; also induction of talent from private sector (recommendation of P J Nayak Committee)

- Bank Boards Bureau – BBB will be a super authority (Autonomous Body) of eminent professionals and officials for public sector banks (PSBs).

Replaces the Appointments Board of Government.

Advise the banks on how to raise funds and how to go ahead with mergers and acquisitions.

Will also hold bad assets of public sector banks.

It will be a step into eventual transition of the bureau into a bank holding company and will separate the functioning of the banks from the government by acting as a middle link. - Capitalisation

- Capitalisation of the banks by inducing Rs 70,000 crore into the banks in the next 4 years

- Banks are in need of capitalisation due to high NPAs and due to need to meet the new BASEL- III norms

- De-stressing: Solve issues in the infrastructure sector to check the problem of stressed assets in banks.

- Empowerment: Greater autonomy for banks; more flexibility for hiring manpower.

- Framework of accountability: The banks will be assessed on the basis of new key performance indicators. These quantitative parameters such as NPA management, return on capital, growth and diversification of business and financial inclusion as well as qualitative parameters such as human resource initiatives and strategic steps to improve assets quality.

- Governance Reforms: GyanSangam conferences between government officials and bankers for resolving issues in banking sector and chalking out future policy.

Q) The Chairman of public sector banks are selected by the

(a) Banks Board Bureau

(b) Reserve Bank of India

(c) Union Ministry of Finance

(d) Management of concerned bank

Indradhanush 2.0

Government plans to come out with ‘Indradhanush 2.0’, a comprehensive plan for recapitalisation of public sector lenders, with a view to make sure they remain solvent and fully comply with the global capital adequacy norms, Basel- III. ‘Indradhanush 2.0’ will be finalised after completion of the Asset Quality Review (AQR) by the Reserve Bank, which is likely to be completed by March-end.

“if you don’t have a functioning financial system the world economy won’t be revived. All the major economies have their responsibility to assist at a pace which is required to clean up the balance sheet of the banking system and to ensure that credit flows are resumed’ –Manmohansingh

Some Important Committees on Banking Reforms:

Narasimhan Committee:

The Narasimham Committee was established under former RBI Governor M. Narasimham in August 1991 to look into all aspects of the financial system in India.

The report of this committee had comprehensive recommendations for financial sector reforms including the banking sector and capital markets. In broad acceptance to this committee, the government announced slew of reforms.

Narasimhan Committee – I (1991):

- Statutory Liquidity Ratio (SLR) is brought down in a phased manner to 25percent (the minimum prescribed under the law) over a period of about five years to give banks more funds to carry business and to curtail easy and captive finance.

- The RBI should reduce Cash Reserve Ratio (CRR) from its present high level to 10 percent.

- The priority sector should be scaled down from present high level of 40 percent of aggregate credit to 10 percent. Also the priority sector should be redefined.

- Interest rates to be deregulated to reflect emerging market conditions.

- Banks whose operations have been profitable is given permission to raise fresh capital from the public through the capital market.

- Balance sheets of banks and financial institutions are made more transparent.

- Government should indicate that there would be no further nationalisation of banks, the new banks in the private sector should be welcome subject to normal requirements of the RBI, branch licensing should be abolished and policy towards foreign banks should be more liberal.