Previous Year Queations

- What were the factors responsible for the successful implementation of land reforms in some parts of the country? Elaborate.(2024)

- State the objectives and measures of land reforms in India. Discuss how land ceiling policy on landholding can be considered as an effective reform under economic criteria.(2023)

- How did land reforms in some parts of the country help to improve the socio-economic conditions of marginal and small farmers?(2021)

- Discuss the role of land reforms in agricultural development. Identify the factors that were responsible for the success of land reforms in India.(2016)

- In view of the declining average size of land holdings in India which has made agriculture non-viable for a majority of farmers, should contract farming and land leasing be promoted in agriculture ? Critically evaluate the pros and cons.(2015)

- The right to fair compensation and transparency land acquisition, rehabilitation and resettlement act, 2013 has come into effect from 1 January 2014. What implication would it have on industrialization and agriculture in India?(2014)

- Establish the relationship between land reform, agriculture productivity and elimination of poverty in Indian Economy. Discussion the difficulty in designing and implementation of the agriculture friendly land reforms in India.(2013)

Land Reforms

Colonialism shattered the basis of traditional Indian agriculture. Commercialization of agriculture & differentiation between the peasantry occurred on a large scale. However, unlike independent societies undergoing transition from preindustrial & pre-capitalist mode of production to capitalist mode of production, in India, commercialization and differentiation didn’t mark the shift towards capitalist commodity production and rise of the capitalist farmer.

In India, commercialization of agriculture led to extraction of surplus from the peasantry in the form of land revenue and the transfer of this surplus from India to Britain by exporting agriculture produce.

Differentiation of peasantry led to the creation of a rent collecting Zamindar (Landlord class) and not the creation of a capitalist farmer. (A tenant farmer is not a wage worker. He takes land on rent).

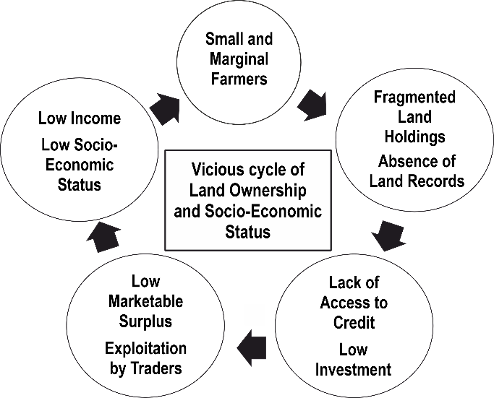

Impact of Small land holdings:

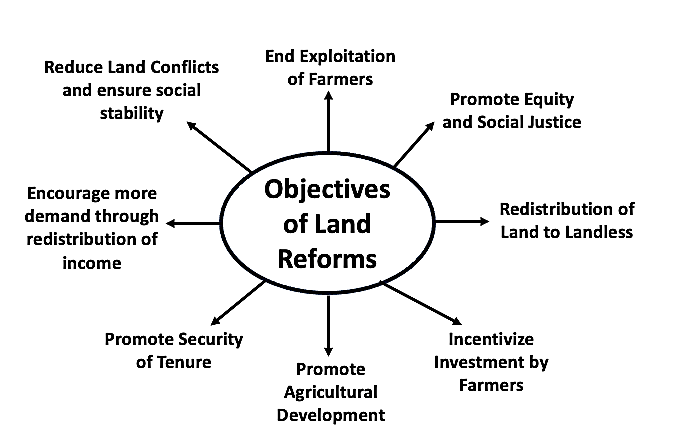

Objectives of Land Reforms:

Features of Indian Agriculture under British Period

(i) A very high tax demand

(ii) Huge indebtedness of the peasants

Tax Demand

Tax was collected by 3 methods

- Zamindari System /Permanent Settlement (Sunset Clause)

In India, during the Mughal Period (before 1765), Zamindars or revenue collectors collected revenue on behalf of the Mughal Emperor, whose representatives or diwans supervised their activities. The Zamindar served as an intermediary who collected economic rent from the cultivators and after withholding a percentage for his own expenses made the rest available as revenue to the state. Under the mughal period, the land itself belonged to the state and not to the Zamindar, who could transfer only his right to collect the rent.

In India, the rule of the British East India company started from 1757, after the battle of Plassey and after the defeat of Shah Alam II in the battle of Buxar, the diwani rights (right to collect the revenue) over Bengal, Bihar and Orissa was handed over to the company.

Lord Cornwallis, the Governor General of Bengal introduced the permanent settlement system in Bengal, Bihar and Orissa which continued in India till India achieved its freedom. Its chief aim was to impart stability to the revenue system.

He did an exhaustive survey of the past records and on the basis of the past 10 years, he fixed how much revenue can be collected from the entire land and fixed the amount to be collected for future years.

Before the tenure of Cornwallis, the landlords (Zamindars) were not considered to be the owners of the land. By the permanent settlement, the landlords were accepted to be the owners of the land in place of peasants. The revenue began to be realized from the landlords instead of from the farmers. The Zamindars and revenue collectors were converted into landlords. They were not only to act as agents of the government in collecting land revenue from the peasants but also to become the owners of the entire land in their Zamindari. Their right of ownership was made hereditary and transferable.

Land revenues were fixed at a very high rate. The Zamindar was the intermediary between state & cultivator. However, as the revenue was fixed, the government found out that it wasn’t able to take profit from increased prices that occurred overtime. The increase in income was largely taken away by Zamindars.

Also, the government thought that if it could collect revenue directly from the farmers, the revenue which was earlier collected by the Zamindars could now be collected by the government and it won’t have to pay a cut to the Zamindar.

- Ryotwari system

It was introduced by Thomas Munro and Alexander Reed in Bombay and Madras presidencies in 1820. Here the revenue settlements were made directly with the farmers called ryots and there wereno intermediaries.

The revenue was collected by the British agents. The land revenue demand was fixed by the state which was as high as 50% where the lands were unirrigated and 60% where the lands were irrigated. The cultivator or ryot was recognized as the owner of the land. Each peasant was given a ‘patta’ by the government which was a piece of document confirming the ownership right of the ryot.

While in theory, the Ryotwari conferred rights on the actual landowners, in reality, the actual cultivator was often different from the owner. The Ryotwari settlement was not made permanent and was revised periodically.The government retained the right to enhance land revenue at will.

- Mahalwari system

Mahal means a village. Under this method the base of revenue collection was a village. The village collectively paid revenue to the state. The ownership rights of the peasants were recognized and a leading family of village, known as lambardar or mahaldar was given rights by the company to fix individual shares and collect the revenue. Sometimes, mahaldars used to exploit peasants and fix land revenue arbitrarily.

It was a modified version of the Zamindari settlement and was introduced in the Ganga valley, Northwest provinces, parts of Central India and Punjab in 1833 in the tenure of William Bentick.

Reasons for high tax demand

Under colonialism there was growth of landlordism and high rent collection. The colonial system created ideal conditions for tenancy and high rent collection. The destruction of traditional handicraft and artificial industries and absence of modern industry created a huge pressure on agriculture.

Further, the growth in the differentiation of the peasantry (zamindars and tenants) and the consequent concentration in landownership were adding to the number of landless people who were hungry for land. The peasant who didn’t pay land revenue his land was taken away by money lenders or landlords in later years. Then that farmer also became a tenant.

In this situation it made more economic sense for the large landlords to give their land on rent rather than going for larger scale capitalist agriculture using labourers under their own supervision. Therefore, they leased out their lands to small tenants and peasants who continued to cultivate them with traditional techniques.

The Zamindar could earn a lot by rent collection and therefore he didn’t take a pain in investing like a capitalist farmer. More people were dependent on agriculture. So, there was competition among tenants for the land. Tenants were ready to pay more rent to have a piece of land so the landlord instead of cultivating himself found it more feasible to give out land on rent.

Given the above conditions, the bulk of the Indian peasantry was without any financial resources and the upper section of the rural societies found rent collecting more profitable than capitalist agriculture.

The heavy demands on the cultivator made the peasantry extremely indebted. The moneylenders charged a high rate of interest from the needy. Bonded laborers became a common feature.

Farmers took money from money tenders for their urgent needs as they were short of money due to high rent. When they were not able to repay the loan or when they didn’t pay rent to the landlord they were forced into bonded labour, where generations worked. This was the basis of bonded labour.

As the land didn’t belong to the tenant and he could be evicted any time by the Zamindar, he also didn’t want to make any sort of investment in the land. Moreover, the leasing out of land to many led to land fragmentation.

The Britishers were never interested in staying in India for a long term. So, they also did not invest in agriculture.

Therefore, very little agricultural investment took place. Neither the cultivators nor the Zamindar took interest in investment and the Britishers were always focused on revenue collection so there was also no investment from the government side in agriculture.

Therefore, the Indian agriculture which was facing stagnation during British period showed signs of going down in the final period of colonial rule.

At the time of independence, India was facing severe food shortage and had to import food grains worth half of the total capital investment value in the first 5 year plan. Food shortage was seriously affecting India’s development efforts. Food self-sufficiency was a primary concern as it would reduce dependence on foreign help.

Various attempts were made to reduce the burden on the peasant and to increase the production.

Land Reforms

Land Reforms usually refer to redistribution of land from rich to poor. More broadly, it includes regulation of ownership, operation, leasing, sales and inheritance of land.

In an agrarian economy like India with great scarcity and unequal distribution of land, coupled with a large mass of below poverty line rural population, there are compelling economic and political arguments for land reform.

At the time of independence, ownership of land was concentrated in the hands of few. This led to the exploitation of the farmers and was a major hindrance towards the socio-economic development of the rural population.

Equal distribution of land was therefore an area of focus of independent India’s government, and land reforms were seen as important pillars of a strong and prosperous country. Therefore, it received top priority on the policy agenda at the time of independence.

In the decades following independence, India passed a significant body of land reforms legislation. The constitution of India has left the adoption and implementation of land and tenancy reforms to state governments. This led to a variation in the implementation of these reforms across states and time.

Following are the major land reforms introduced in India after independence:

The process of land reforms after independence occurred in 2 phases.

- Reforms started soon after independence and continued till early 1960s. They were called Institutional reforms.

They included:

- Abolition of intermediaries i.e., Zamindari Abolition

- Tenancy reforms

- Providing security of tenure to tenants

- Decrease in rents

- Giving ownership rights to the tenants

- Ceiling on size of land holding

- Consolidation of Landholdings

- Computerization of Land Records

- Reforms from the mid 1960s.

They were called technological reforms. They included the green revolution.

The two phases are not to be divided into rigid watertight compartments. In fact, they were complementary to each other (one enforced the other) and there was a fair degree of overlap in the program

Zamindari Abolition

By 1949, Zamindari abolition bills were introduced in a number of provinces but there were widespread apprehensions among the congress leaders that the Zamindars could try to stop the acquisition of their property by going to the court and by raising the issue of violation of the fundamental right to property or for the excuse of injustice in compensations. Therefore, the first constitutional amendment & 4th amendment were brought to strengthen the hands of the state legislature for implementing Zamindari abolition.

In the first amendment, laws related to land reforms & acquisitions were kept in 9th schedule i.e., beyond judicial review, so that Zamindar couldn’t go to court. Under these amendments, litigation for violation of any fundamental right of property or insufficiency of compensation while acquiring land wasn’t permitted in the court.

4th amendment: The compensation given to the landlord was made beyond judicial review. But the Zamindars continued to make petitions to the courts to stop taking away their lands. 1st Constitutional Amendment Act added 3 things to the constitution: –

- 2 new articles (31A & 31B)

- 1 schedule (9th)

Article 31A: State can make laws to acquire any estates/rights related to estates.

Article 31B: Acts listed in 9th schedule can’t be challenged in the court.

9th Schedule:1st constitutional amendment act listed 13 acts in 9th schedule all meant for Zamindari abolition.

Zamindari Abolition Act: Salient Features

Compensation: Ownership & land revenue related rights of Zamindars were abolished. Land was transferred to tenants who were made the owners & the state government gave compensation to Zamindars who lost their land,

Common Land: Earlier common land belonged to the Zamindars. They controlled it & charged fees if someone else wanted to use it. Zamindari Abolition Acts transferred such land to the village panchayat.

Ownership transfer: Land was brought under personal cultivation.

By 1956, Zamindari Abolition acts were passed in most of the provinces.

One of the difficulties faced in Zamindari abolition was the absence of land records. Still by the end of 1950s, the Zamindari abolition was almost completed.

This was possible partly because the Zamindar class was isolated socially during the national movement as they were seen as a part of the imperialist camp. The area under tenancy decreased from 42% in 1950s to approx 22% by early 1960s.

However, the decline in tenancy wasn’t a result of tenants becoming landowners but also due to the fact that many tenants were evicted by the landowner. Under the government’s clause of land to the tiller, a person who cultivates land could keep the land with himself. Due to this, landowners evicted many tenants and started to cultivate the lands themselves under the clause of personal cultivation.

As land was given to the tiller, the government paid compensation to the zamindars, who lost their lands.

The compensation paid to the Zamindar was generally small and varied from state to state depending on: –

Strength of peasant movement against the British rule.

The class balance between the landlords and the tenants.

The ideological composition of the congress leadership and of the legislature as a whole.

However, the payment of compensation stretched over a long period.

Weaknesses in Zamindari Abolition

Absence of land records was the biggest hurdle. Without land records it could not be found out who was cultivating whose land.

Zamindars were allowed to keep the land under personal cultivation and there was no limit on the land to be declared under the personal cultivation of the Zamindars, but what constituted personal cultivation was very vaguely defined. Due to the zamindars who were earlier absentee landlords could now keep large amounts of lands with themselves.

Further in order to declare more land under personal cultivation a large scale eviction of tenants took place. However, personal cultivation clauses had certain positive results too. Many of the Zamindars who kept the land under personal cultivation, invested in it and moved towards progressive capitalist farming (this was one of the objectives of the land reform movement; to increase the food grain production).

The MLAs who were sympathetic to the cause of Zamindar used every possible method of parliamentary obstruction in the legislatures. The bills were subjected to long debates and many amendments were proposed. In many states like the U.P. & Bihar, many years passed between the introduction of the bills & the laws being enacted.

Even after the laws were enacted, the landlords used the judicial system to defer the implementation of the law. The Zamindars refused to hand over their land records to the government, which forced the government to follow the lengthy procedure of reconstruction of the land records!!!The implementation of the law was also difficult because of the nexus between the Zamindars and the lower-level revenue officials (most of the revenue officials were former rent collecting agents of the Zamindars).

Despite the resistance of the landlords, the process of Zamindari abolition was completed except in certain parts of the country. The main beneficiaries were the occupancy tenants who now became landlords.

The issue of tenancy continued even after the abolition of the Zamindari system. Such tenancy existed on the lands of former Zamindars. It was called oral tenancy. The lands which the Zamindars declared to be under personal cultivation were given to tenants. Also, the earlier tenant who now became a landowner gave his land on rent.

The political and economic conditions in different parts of Indian were so varied that the tenancy legislation passed by the different states and manner of implementation also varied a lot.

Tenancy Reforms

Objectives of tenancy reforms: –

1. Guarantee of security of tenure to the tenants who had cultivated a piece of land for a fixed number of years (number of years varied from state to state).

2. Reduce the rents paid by tenants to a fair and just level.

3. The tenant should gain the right to acquire ownership of land he had cultivated subject to certain restrictions. The tenant was expected to pay a price much below the market price (Generally a multiple of annual rent).

The aim of zamindari abolition and tenancy reforms was same: land to the tiller.

Again, the tenants’ right to acquire the landowners land was restricted by the condition that the land owner wasn’t to be deprived of all his land. Also, the tenants holding after acquisition of the land of the Zamindar couldn’t exceed the ceiling prescribed by each state.

The economic circumstances of small owners were not so different from that of tenants and the tenancy legislation worked to their disadvantage. Therefore, the second 5 Year plan envisaged that very small landowners could resume their entire holding for personal cultivation.

However, the actual implementation of the tenancy laws was complicated. Due to the above provisions (protection of small landowners) there was misuse by the larger landlords. They connived with the revenue officials and transferred their lands in the names of a number of relatives so as to enter the category of small landowners.

After this, the landowners evicted the tenants from such lands by exercising the right of resumption given to small owners.

In fact, the right of resumption and the loose definition of personal cultivation was used for eviction of tenants on a large scale.

The process of eviction had begun in anticipation of tenancy legislation coming in near future. The long delays in enacting the laws created vested interests enabling them to evict potential beneficiaries before the law came into force.

Even after the tenant got legal protection against eviction, large scale evictions continued.

Voluntary surrenders were another excuse for illegal eviction. Under voluntary surrenders the tenant could surrender the land to the landlord. The tenant was threatened by the landlord to give up the right to land, but the landlord would claim that the tenant had voluntarily surrendered the land to the landowner for personal cultivation.

The fourth plan recommended that all surrenders should be in favor of the government, which would allot such lands to the eligible persons. However, only a few states acted on this recommendation. In many cases tenancy continued in a hidden form. The tenants were now called farm servants though in reality they had the same status as that of the tenants.

In the early years of land reforms, tenants were converted to sharecroppers. Sharecroppers were now treated as tenants and were not protected under tenancy legislation. Only cash rent payers were treated as tenants and tenants who paid in kind were called sharecroppers.

What contributed to insecurity of tenants was the fact that most tenancies were oral and informal i.e., they were not recorded and the tenants couldn’t benefit from the legislation.

The absence of proper records was a major obstacle in the implementation of the Zamindari abolition & land reform act. A massive drive was launched by the farmer leader Charan Singh to get a few million records corrected. In the later years many such drives were started under the power of left forces. The targeted beneficiaries were no longer the upper or middle level tenants but also the sharecroppers & small tenants.

Therefore, the only benefit of tenancy legislation was that a substantial portion of tenants acquired security and permanent occupancy rights.

Permanent tenant or occupancy tenants: when tenancy rights are permanent, hereditary and passed on to generations. They have security of tenure and could claim compensation from the landlords for any improvement done on the land.

Tenant at will: They did not have any security of tenure, and they were made to pay exorbitant rent to the landlords and could be evicted from the land whenever the landlord so desired or were evicted at will.

Subtenant: When a tenant gives land to another tenant.

The only positive of tenancy reforms was that it caused positive impact on levels of investment and improvement in productivity and hence brought a decrease in poverty in the field of such secure tenants

Operation Barga:

It was launched in the state of West Bengal by the left front government with the objective of registration of sharecroppers in a time bound period so that they can then proceed to secure for themselves, their legal rights namely permanent occupancy & heritable rights.

In operation Barga, the support of the rural poor and especially the targeted beneficiary was sought in the implementation of the reform measures. It neutralized the lower-level revenue officials like Patwaris etc. who often acted as major obstacles in the successful implementation of government programs.

Reason for stagnation of operation Barga

It was politically impossible and ethically indefensible as many landlords were cultivators themselves with holdings only marginally larger than those of the sharecroppers.

In West Bengal, the majority of the cultivators were small cultivators controlling less than 5 acres. Therefore, a further redistribution was difficult, and the government had to balance the interest of small landowner and tenants.

The land man ratio in Bengal was such that the landlord was able to rotate a piece of land among two or more sharecroppers. Registering any one of the tenants would permanently remove the other. Also, if the tenants were registered in such a situation the size of the holdings would fall below the optimum level.

Limitations of tenancy reforms

The first objective of tenancy legislation was to provide security of tenure to all tenants, but it met with limited success. The practice of insecure tenancy mostly oral, continued in India on a large scale.

The second objective of tenancy legislation was to bring the rent to a fair and just level. But the presence of so many insecure tenants was the major obstacle in this area. This led to a tenant getting ready to pay rent higher than the legal and fair rent. The legal and fair rent could only be enforced in the case of tenants who were registered with the state government.

Further the green revolution aggravated the problem. Land rents increased further.

The third objective of the acquisition of ownership rights by tenants was achieved only partially. The reasons were right to resumption by landowners, legal and illegal evictions, voluntary surrenders, shift towards oral or concealed tenancy.

One of the reasons that the larger number of tenants didn’t acquire ownership rights was that for the tenants who had acquired permanent occupancy rights and achieved rent reduction, there was hardly any motivation to try & acquire full ownership. This process would not only involve raising capital (lawyer’s fees) but also legal and other complications.

The cumulative effect of abolition of Zamindari, tenancy and ceiling legislation was the meeting of one of the major objectives of land reforms which was creation of progressive cultivators who would make investment in the land and improve its productivity.

Abolition of Zamindari led to about 20 million tenants becoming landowners and many absentee Zamindars turning to direct cultivation in the lands by “resumed personal cultivation”.

The tenants and sharecroppers got occupancy rights or paid reduced fixed rents (the landless got the land which was declared surplus over the ceiling limits and the absentee landowners become direct cultivators)

All of them had the motivation to become progressive farmers based either on their own resources or on credit from banks which become increasingly available to the poorer peasants.

Ceiling and Bhoodan Movement

Land ceiling

Another aspect of the land reform movement in India was the imposition of ceilings on the size of land holdings with the objective of making land distribution more equitable.

However societal consensus was weak on this question and there was very little success in implementation of this program. The first five year plan was in favor of an upper limit on the amount of land that an individual may hold. However, the upper limit was to be decided by each state separately.

In the meantime, opposition to ceilings was building up in large parts of the country. A threat to the right to property was perceived by the landowners. The complainers and beneficiaries of Zamindari abolition, the tenants who had now become the landowners, all came up against the attempt of redistribution of land ownership through imposition of land ceilings.

The states also were not in any hurry to enact any land ceiling act.

Weaknesses in land ceiling legislation

In a situation where more than 70% of the landholdings in India were less than 5 acres the ceilings fixed by the states were very high.

In Andhra, it was from 27 to 312 acres Assam 50 acres, Punjab 30-60 acres etc.

Moreover, in most states the ceilings were imposed on individuals and not on family holdings. It enabled the landowners to divide up their land for the sake of formality & registering it in the names of relatives, just to avoid the ceiling. Further in many states the ceiling could be raised too.

The long delay as well as the legislation ensured that the ceilings had a very little impact & released little land for redistribution.

A large number of exemptions to the ceiling limits were permitted by most of the states. According to the second five-year plan, certain categories of land could be exempted from ceilings e.g., Tea, Coffee, Rubber Plantation, Orchards, farms for cattle breeding etc.

The intention was to promote progressive or capitalist farming done on a large scale and at the same time try to end the absentee landlordism.

However even this method wasn’t problem free. Many times, the exemptions were absurd.

Criteria such as efficiently managed farms was quite vague. A large number of farmers declared their lands as efficiently managed and thus evaded the ceilings. Similarly, the exemption to land held by cooperatives was also misused. Many landlords transferred their lands to bogus co-operatives.

The only positive of these exemptions was that some landowners shifted to efficient farming in order to save their lands from being taken off the government under the ceilings act.

The long delay in bringing the ceiling legislation also defeated its very purpose. The large landowners had enough time to either sell their excess land or transfer it in the names of relatives. The landowners also resorted to mass eviction of tenants, resuming cultivation on their lands at least up to the ceiling limit and claiming falsely to have shifted to progressive farming under their direct supervision.

Thus, by the time the ceiling legislations were in place, there were barely any holdings left above the ceiling limit. Despite the ceiling legislation being passed by most states by 1961, till the end of 1970 not a single acre was declared surplus in large states like Bihar, Mysore, Rajasthan, Orissa etc.

Second Spurt of Land Reforms

In the wake of the political and economic crisis of the mid 1960s, a strong agrarian radicalism emerged in large parts of the country. The naxalite movement led by CPI-ML(Marxist – Leninist) peaked in West Bengal and parts of Andhra.

West Bengal saw widespread land grab movement by the landless. The poor would come together and forcibly seize the land of the large landowners. The total amount of land seized wasn’t very significant and most of it was government waste land, land which was taken over by the government but was not distributed to the poor.

The movement was suppressed. However, despite the very limited success in land seizure and the quick suppression of the movement, on the whole, it had a significant symbolic effect. The nation’s attention was drawn to the agrarian question. This was the context of the second spurt of land reforms which occurred in the 1960s and early 1970s.

The central land reforms committee made a series of recommendations.

They were:

1. Decrease in the level of ceiling limit.

2. Withdrawal of exemption is favour of efficiently managed or mechanized farms.

3. Making the ceiling limit applicable to the family as a unit and not to the individuals as was the case earlier.

4. In the distribution of surplus land, priority was to be given to landless agricultural workers especially those belonging to SCs & STs.

Following the above guidelines most states lowered the ceiling limits within the range prescribed in the guidelines.

Resistance to the ceiling laws and efforts to evade the ceiling continued in a variety of ways. A common method was to seek judicial intervention

In an attempt to stop this problem, the government enacted the 34th amendment act, 1974 and included most of the revised ceiling laws in the 9th schedule so that they could not be challenged on constitutional grounds.

While the revised effort of the 1970s led to some progress in surplus land being redistributed but the overall result was still far from satisfactory. The objective of distributing surplus lands to village co-operatives or using such lands to start new co-operatives didn’t achieve any success.

There was wide regional variation in the implementation of ceiling laws. The states where greater political mobilization of the targeted beneficiaries occurred or where greater political will was shown by the government, a higher level of success was achieved.

Thus, while there was a distinct improvement after 1972, yet the total area declared surplus which could be distributed among the landless constituted only about 2% of the cultivated land.

On the positive side the ceiling law discouraged concentration of land ownership beyond the ceiling level and thus prevented the possible dispossession of numerous small and marginal holders. If there was no ceiling law and had the marginal farmers been getting very little profit by cultivating their land, then they could have been enticed by the large landowners to sell their lands to them.

But as there was a limit on the amount of land which a person could hold, the large landowners didn’t show any interest in purchasing land of the marginal farmer, as it would have taken his total land to a limit greater than the ceiling limit. Hence the ceiling stopped dispossession of marginal farmers.

Though the opportunity to acquire large areas of surplus land for redistribution was missed by the government, because of defective and delayed ceiling laws; in the long run, the high population growth and rapid subdivision of large land holdings, automatically led to little land remaining above the ceiling limit.

Why isn’t the land ceiling possible now?

Given the adverse land man ratio and the fact that a very high proportion of the population continues to be dependent on agriculture, the number of competitors for land is very high. Any attempt to further reduce ceilings to provide land for landless laborers would increase the number of uneconomic holdings.

Also, it would turn the politically important, the landowning classes under the new farmers movement against any political party which tries to do so.

Perhaps the only option left for landless laborers is to ensure payment of minimum wages, security of tenure and fair rents to sharecroppers and tenants. The other solution can be increasing the nonfarm and non-agricultural employment in rural areas, increasing animal husbandry and other activities associated with cultivation which do not require land.

New farmers’ movement

Prior to independence all farmers were poor but after reforms & especially the green revolution, the farmers became rich and with money came power. Now their demand is not about land. The level has risen. They now demand for high MSP, free electricity etc.

Bhoodan Movement

Bhoodaan was an attempt at land reform by bringing institutional changes in agriculture like land redistribution through a movement and not simply through government legislation.

Acharya VinobaBhave launched this movement in early 1950s. He organized an All-India Federation of constructive workers called the SarvodayaSamaj. It was to take up the task of nonviolent social transformation in the country. He and his followers did Padyatra to persuade the larger landowners to donate at least 1/6 of their lands as Bhudaan or land gift for distribution among the landless and the poor.

The target was to donate 50 million acres which was 1/6th of the 300 million acres of cultivable land in India. The movement, though independent of the government, had the support of congress, which urged its members to participate in the movement.

Limitation of the movement

In the initial years, the movement achieved considerable success, but it soon lost momentum.

A substantial part of the land donated was unfit for cultivation or was under litigation. Perhaps this was the one reason that out of the nearly 4.5 million acres of land donated only about 0.6 million acres was actually distributed.

Towards the end of 1955, the movement took a new form, that of Gramdaan or donation of village. Gramdan movement is a movement in which an entire village is donated to the society as a whole. The private ownership over land ceases to exist. All the villagers work together according to their best ability and receive whatever is necessary for them. It was declared that all the land in the Gramdan movement was owned collectively or equally as it didn’t belong to any one individual. The movement started in Orissa & was most successful there.

It is said that this movement was successful mainly in villages where class differentiation had not yet emerged and there was little disparity in ownership of land.

Vinoba picked such villages which were mostly inhabited by the tribals for this movement. By the 1960s, the Bhoodan/Gramdan movement lost its charm despite its original promise. Its creative potential remained unutilized. The SarvodayaSamaj on the whole failed to make a transition from a local movement to an active large scale, mass movement.

Positives of Sarvodaya Movement

It wanted to bring land reform through a movement & not through government legislation. This was an achievement in itself.

The potential of the movement was enormous as it was based on the idea of trusteeship or that all land belonged to God and the landlords were first trustees. If the landlords failed to behave as trustees or equal sharers of prosperity then a Satyagraha in the Gandhian form could be launched.

The movement made a significant contribution by creating a moral atmosphere which put pressure on the landlords and created conditions favorable to the landlords.

Consolidation of land holdings

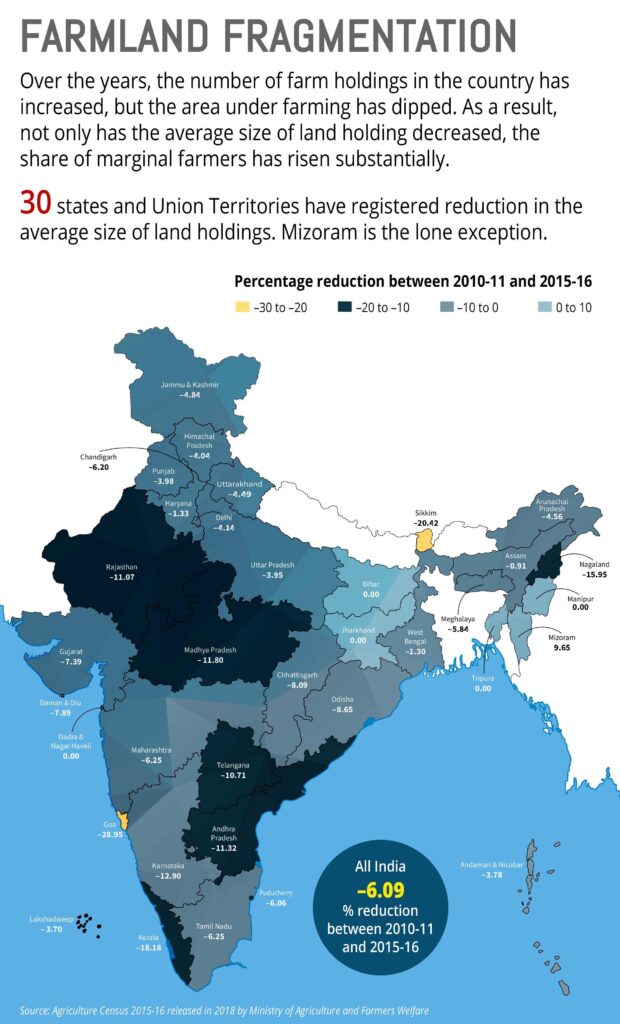

Consolidation of land holdings means bringing together the various small plots of land of a farmer scattered all over the village as one compact block, either through purchase or exchange of land with others. The average size of holdings in India is very small.

The size of the land holdings is decreasing but the number of holdings is increasing over time. This is due to the inheritance laws because of which farms are being subdivided and fragmented with every passing generation. Subdivision and fragmentation of holdings results in several disadvantages such as wastage of land, difficulties in land management, difficulty in the adoption of new technology, disputes over boundaries, low productivity etc.

There were various obstacles to the speedy implementation of the consolidation programme. These were poor response from the cultivators due to the perceived advantage of having land in fragmented parcels in the event of floods and other natural calamities or acquisition ,complicated process of land consolidation, wide variation in the quality of land, lack of enforcing machinery, lack of political will, emotional attachment of people to their land and reluctance to part away with their land holding, unwritten and incomplete land records, lack of administrative staff to carry out consolidation of land holdings etc.

Evaluation of consolidation

Only in Punjab and Haryana, the task of consolidation has been undertaken on a considerable extent. In some states, consolidation has not at all been undertaken.

Effects of Zamindari abolition/Land reforms

- Agricultural production increased

- Improvement in the conditions of the tenants

- No land revenue was to be paid

- Changed rural power structure towards egalitarian society.

- Rise of the middle class.

- Increase in investment in agriculture

- Decrease in poverty

To conclude, land reforms in India have largely been a failure. Apart from the factors mentioned earlier, other factors are,

- Lack of political will

- Apathy of bureaucracy

- Corruption

- Land owning by Bureaucracy and political class

- Linkage between bureaucracy, politicians and land-owning class

Model Agricultural Land Leasing Act, 2016

The model Act seeks to permit and facilitate leasing of agricultural land to improve access to land by the landless and the marginal farmers. It also provides for recognition of farmers cultivating the leased land to enable them to access loans through institutional credit.

Land lease agreement: The lease agreement between the landowner and cultivator will include information pertaining to:

(i) the location and area of leased out land,

(ii) the duration of lease,

(iii) the lease amount and the due date by which rent has to be paid, and

(iv)terms and conditions for the renewal or extension of lease.

The lease period and lease amount will be based on a mutual agreement between the landowner and cultivator. Additionally, the lease agreement will not confer any protected tenancy right on a cultivator.

The lease agreement may or may not be registered (as mutually agreed) and will also not be entered into any record of rights.

Enforcement of lease agreement: The tahsildar or a revenue officer of equal rank will be responsible for,

(i) enforcement of terms of lease, and (ii) facilitating return of the leased out agricultural land to the owner on expiry of the lease period.

Dispute resolution: The cultivator and the owner can settle disputes between them using third party mediation, or Gram Panchayat, or Gram Sabha. If the dispute cannot be settled by third party mediation, either the landowner or the cultivator can file a petition before the Tahsildar, or an equal rank revenue officer. He will have to adjudicate the dispute within four weeks. In such cases, an appeal can also be made to the collector or district magistrate.

Special Land Tribunal: State governments will constitute a special Land Tribunal, which will be the final authority to adjudicate disputes under the model Act. It will be headed by a retired high court or district court judge. No civil courts will have jurisdiction over disputes under the model Act.

Land Leasing: A Big Win-Win Reform for the States by Arvind Panagariya, Vice Chairman, NITI Aayog

Land leasing laws relating to rural agricultural land in Indian states were overwhelmingly enacted during decades immediately following the independence. At the time, the abolition of Zamindari and redistribution of land to the tiller were the highest policy priorities. Top leadership of the day saw tenant and sub-tenancy as integral to the feudal land arrangements that India had inherited from the British. Therefore, tenancy reform laws that various states adopted sought to not only transfer ownership rights to the tenant but also either prohibited or heavily discouraged leasing and subleasing of land.

Politically influential landowners were successful in subverting the reform, however. As P.S. Appu documents in his brilliant 1996 book, Land Reforms in India, till as late as 1992, ownership rights were transferred to the cultivator on just 4% of the operated land. Moreover, just seven states, Assam, Gujarat, Himachal Pradesh, Karnataka, Kerala, Maharashtra, and West Bengal, accounted for some 97% of this transfer.

In trying to force the transfer of ownership to the cultivator, many states abolished tenancy altogether. But while resulting in minimal land transfer, the policy had the unintended consequence of ending any protection tenants might have had and forced future tenants underground. Some states allowed tenancy but imposed a ceiling on land rent at one-fourth to one-fifth of the produce. But since this rent fell well below the market rate, contracts became oral in these states as well, with the tenant paying closer to 50% of the produce in rent.

Many large states including Telangana, Bihar, Karnataka, Madhya Pradesh and Uttar Pradesh banned land leasing with exceptions granted to land- owners among widows, minors, disabled and defence personnel. Kerala has for long banned tenancy, permitting only recently self-help groups to lease land.

Some states including Punjab, Haryana, Gujarat, Maharashtra and Assam did not ban leasing but the tenant acquired a right to purchase the leased land from the owner after a specified period of tenancy. This provision too has the effect of making tenancy agreements oral, leaving the tenant vulnerable. Only the states of Andhra Pradesh, Tamil Nadu, Rajasthan and West Bengal have liberal tenancy laws with the last one limiting tenancy to sharecroppers. A large number of states among them Rajasthan and Tamil Nadu, which otherwise have liberal tenancy laws, do not recognize sharecroppers as tenants.

The original intent of the restrictive tenancy laws no longer holds any relevance. Today, these restrictions have detrimental effects on not only the tenant for whose protection the laws were originally enacted but also on the landowner and implementation of public policy. The tenant lacks the security of tenure that she would have if laws permitted her and the landowner to freely write transparent contracts. In turn, this discourages her from making long-term investments in land and also leaves her feeling perpetually insecure about continuing to maintain cultivation rights. Furthermore, it deprives her of potential access to credit by virtue of being a cultivator. Landowners also feel a sense of insecurity when leasing land with many choosing to leave land fallow. The latter practice is becoming increasingly prevalent with landowners and their children seeking non-farm employment.

Public policy too faces serious challenges today in the absence of transparent land leasing laws. There are calls for expanded and more effective crop insurance. Recognizing that such insurance is likely to be highly subsidized, as has been the case with the past Programmes, a natural question is how to ensure that the tenant who bears the bulk of the risk of cultivation receives this benefit. The same problem arises in the face of a natural calamity; if tenancy is informal, how do we ensure that the actual cultivator receives disaster relief?

In a similar vein, fertilizer subsidy today is subject to vast leakages and sales of subsidized fertilizer in the black market. In principle, these leakages could be sharply curtailed by the introduction of direct benefit transfer (DBT) using Aadhar seeded bank accounts along the lines of the cooking gas subsidy transfer. But in face of difficulty in identifying the real cultivator and therefore intended beneficiary, DBT cannot be satisfactorily implemented.

In the context of the difficulties in land acquisition under the 2013 land acquisition law, states wishing to facilitate industrialization can further benefit from liberal land leasing if they simultaneously liberalize the use of agricultural land for nonagricultural purposes. Currently, conversion of agricultural land for non-agricultural use requires permission from the appropriate authority, which can take a long time. State governments can address this barrier by either an amendment of the law to permit non-agricultural use or by the introduction of time-bound clearances of applications for the conversion of agricultural land use in the implementing regulations. The reform opens up another avenue to the provision of land for industrialization: long-term land leases that allow the owner to retain the ownership while earning rent on her land. In addition, she will have the right to renegotiate the terms of the lease once the existing lease expires.

Therefore, the introduction of transparent land leasing laws that allow the potential tenant or sharecropper to engage in written contracts with the landowner is a win-win reform. The tenant will have an incentive to make investment in improvement of land, landowner will be able to lease land without fear of losing it to the tenant and the government will be able to implement its policies efficiently. Simultaneous liberalization of land use laws will also open up an alternative avenue to the provision of land for industrialization that is fully within the state’s jurisdiction and allows the landowner to retain ownership of her land.

A potential hurdle to the land leasing reform laws is that landowners may fear that a future populist government may use the written tenancy contracts as the basis of transfer of land to the tenant and therefore would oppose the reform. This is a genuine fear but may be addressed in two alternative ways. The ideal way would be yet another major reform: giving landowners indefeasible titles. States such as Karnataka that have fully digitized land records and the registration system are indeed in a position to move in this direction.

For other states, such titles are a futuristic solution. Therefore, in the interim, they can opt for the alternative solution of recording the contracts at the level of the Panchayat eschewing acknowledging the tenant in the revenue records. They may then insert in the relevant implementing regulations the clause that for purposes of ownership transfer, only the tenancy status in revenue records would be recognized.

State governments must seriously consider revisiting their leasing (and land use) laws to determine if they could bring about these simple but powerful changes to enhance productivity and welfare all around. We, at the NITI Aayog, stand ready to assist them in this Endeavour.