What is Poverty?

Poverty is a state or situation in which a person or a group of people don’t have enough money or the basic things they need to live. Poverty means that a person doesn’t make enough money from their job to meet their basic needs. People and families who are poor may not have a good place to live, clean water, healthy food, or medical care. Each country can use its own set of rules to figure out how many people are poor.

In India the generally accepted definition of poverty emphasizes minimum level of living rather than a reasonable level of living. In economics there are two important classification of poverty; Absolute Poverty’ and ‘Relative Poverty’.

Absolute Poverty: Absolute Poverty is the sheer deprivation or non-fulfilment of bare minimum needs of existence- of food, shelter, health or education. It is based on the absolute needs of the people and people are defined as poor when some absolute needs are not sufficiently satisfied. Most of the developing countries are experiencing such type. An absolute poverty line is based on the cost of minimum consumption basket based on the food necessary for a recommended calorie intake.

Relative Poverty: Relative Poverty is related with high income countries, where people are poor because they cannot maintain or equivalent to others in the society. There should be differences in living standards among the people. It reflects economic distress, despair and dissension that stem from serious inequalities in income and wealth. The relative poverty line varies with the level of average income. Relative poverty is based on inequality and differences in standard of living.

Measurement of Poverty: It is essential to measure poverty with its various dimensions. The measurement of poverty is needed to plan policies to check this global phenomenon. Therefore consumption data can be used to measure poverty.

Poverty Line: The poverty line in India is defined as ‘the level of private consumption expenditure, which ensures a food basket that would supply the required amount of calories’. The poverty line defines a threshold income. Households earning below this threshold are considered poor. Different countries have different methods of defining the threshold income depending on local socio-economic needs. The erstwhile Planning Commission used to release the poverty measures.

Poverty is measured based on consumer expenditure surveys of the National Sample Survey Organisation. A poor household is defined as one with an expenditure level below a specific poverty line.

India’s Poverty Line

Earlier, India used to define the poverty line based on a method defined by a task force in 1979. It was based on expenditure for buying food worth 2,400 calories in rural areas, and 2,100 calories in urban areas.

In 2011, the Suresh Tendulkar Committee defined the poverty line on the basis of monthly spending on food, education, health, electricity and transport. According to this estimate, a person who spends Rs. 27.2 in rural areas and Rs. 33.3 in urban areas a day are defined as living below the poverty line. For a family of five that spends less than Rs. 4,080 and Rs. 5,000 in rural and urban areas respectively is considered below the poverty line. This has been criticised for fixing the poverty line too low.

According to a committee headed by former Reserve Bank governor C Rangarajan, there were 363 million people, or 29.5% of India’s 1.2 billion people, who lived in poverty in 2011-12. The Rangarajan panel considered people living on less than Rs. 32 a day in rural areas and Rs. 47 a day in urban areas as poor.

Tendulkar Committee vs Rangarajan Committee

- The Expert Group (Tendulkar) had used the all-India urban poverty line basket as the reference to derive state-level rural and urban poverty. This was a departure from the earlier practice of using two separate poverty line baskets for rural and urban areas. The Expert Group (Rangarajan) reverts to the practice of having separate all-India rural and urban poverty basket lines and deriving state-level rural and urban estimates from these.

- The Expert Group (Tendulkar) had decided not to anchor the poverty line to the then available official calorie norms used in all poverty estimations since 1979 as it found a poor correlation between food consumed and nutrition outcomes. However, on a review of subsequent research, the Expert Group (Rangarajan) took a considered view that deriving the food component of the Poverty Line Basket by reference to the simultaneous satisfaction of all three nutrient -norms would be appropriate when seen in conjunction with the emphasis on a full range of policies and programmes for child-nutrition support and on public provisioning of a range of public goods and services aimed at the amelioration of the disease-environment facing the population.

- Estimates of consumption expenditure seen in the National Accounts Statistics and as inferred from the sample surveys of the National Sample Survey Organisation show a large and growing variance. The Expert Group (Rangarajan) prefers NSSO’s estimates and decides not to use the NAS estimates. This is in line with the approach taken by Expert Group (Lakdawala) and Expert Group (Tendulkar).

- The capture of spatial and temporal variation in prices in estimating the State-level and rural-urban poverty levels (given all-India rural and urban estimates) has undergone substantial refinement since 1979. The Expert Group (Rangarajan) agrees with the methodology adopted by the Expert Group (Tendulkar) in this regard. This overcomes the limitations of using fixed base-year weights by using a combination of unit values derived from successive NSSO’s Consumer Expenditure Surveys and price-relatives derived from the Consumer Price Indices.

- Public expenditure on social services has increased substantially in recent years. These expenses are not captured, by design, in the NSSO’s Consumer Expenditure Surveys and the poverty line derived from these is thus lower than the services actually consumed.

- The Expert Group (Rangarajan) is of the considered view that the deployment of criteria other than consumption expenditure in the measurement of poverty raises several issues regarding measurement and aggregation and that these render such exercises impractical. However, the Expert Group (Rangarajan) has considered an alternate view in estimating the poverty line by reference to the ability of households to save.

Arvind Panagariya Task Force

The discussion about different Committees make it clear that defining a poverty line in India has been a controversial issue since 1970s. The latest poverty line defined was by Rangarajan Formula. However, this report also did not assuage the critics. The new NDA Government turned down this report also.

To define the poverty line, The NDA Government had constituted a 14-member task force under NITI Aayog’s vice-chairman Arvind Panagariya to come out with recommendations for a realistic poverty line. After one and half years work, this task force also failed to reach a consensus on poverty line. In September 2016, it suggested to the government that another panel of specialists should be asked to do this job {if defining poverty line}. Informally, this committee supported the poverty line as suggested by Tendulkar Committee.

Why defining poverty line is a controversial issue?

Most of the governments have mothballed the reports of committees and panels because this issue is not only politically sensitive but also has deeper fiscal ramifications. If the poverty threshold is high, it may leave out many needed people; while if it is low, then it would be bad for fiscal health of the government. Third, there is a lack of consensus among states too. We note that some states such as Odisha and West Bengal supported the Tendulkar Poverty Line while others such as Delhi, Jharkhand, and Mizoram etc. supported Rangarajan Line. Thus, no one, including NITI Aayog wants to bell the cat when it comes to count number of poor in the country.

Causes of Poverty in India

Increase rate of rising population:

- In the last 45 years, the population has increased at the whopping rate of 2.2% per annum. An average of approx. 17 million people are added every year to the population which raises the demand for consumption goods considerably.

Less productivity in agriculture:

- In agriculture, the productivity level is very low due to subdivided and fragmented holdings, lack of capital, use of traditional methods of cultivation, illiteracy etc. The very reason for poverty in the country is this factor only.

Less utilization of resources:

- Underemployment and veiled unemployment of human resources and less utilization of resources have resulted in low production in the agricultural sector. This brought a downfall in their standard of living.

A short rate of economic development:

- In India, the rate of economic development is very low what is required for a good level. Therefore, there persists a gap between the level of availability and requirements of goods and services. The net result is poverty.

Increasing price rise:

- Poor is becoming poorer because of continuous and steep price rise. It has benefited a few people in the society and the persons in lower income group find it difficult to get their minimum needs.

Unemployment:

- One of the main causes of poverty is the continuous expanding army of unemployed in our country. The job seeker is increasing in number at a higher rate than the expansion in employment opportunities.

Shortage of capital and able entrepreneurship:

- The much-required capital and sustainable entrepreneurship play a very important role in accelerating the growth. But these are in short supply making it difficult to increase production significantly.

Social factors:

- Our country’s social set up is very much backward with the rest of the world and not at all beneficial for faster development. The caste system, inheritance law, rigid traditions and customs are putting hindrances in the way of faster development and have aggravated the problem of poverty.

Political factors:

- We all know that the East India Company started lopsided development in India and had reduced our economy to a colonial state. They exploited the natural resources to suit their interests and weaken the industrial base of Indian economy. The development plans have been guided by political interests from the very beginning of our independence.

Unequal distribution of income:

- If you simply increase the production or do a checking on population cannot help poverty in our country. We need to understand that inequality in the distribution of income and concentration of wealth should be checked. The government can reduce inequality of income and check the concentration of wealth by pursuing suitable monetary and price policies.

The problem of distribution:

- The distribution channel should be robust in order to remove poverty. Mass consumption of goods and food grains etc. should be distributed first among the poor population. Present public distribution system must be re-organised and extended to rural and semi-urban areas of the country.

Regional poverty:

- India is divided by the inappropriate proportion of poor in some states, like Nagaland, Orissa, Bihar, Nagaland, etc. is greater than the other states. The administration should offer special amenities and discounts to attract private capital investment to backward regions.

Provision for minimum requirements of the poor:

- The government should take care of the minimum requirements, like drinking water, primary medical care, and primary education etc. of the poor. The public segment should make generous expenditure on the poor to provide at least minutest requirements.

Some Government measures to alleviate poverty

National Food Security Act, 2013

- It aims to provide subsidized food grains to approximately two thirds of India’s population i.e. 75% in rural areas and 50% in urban areas.

- It converts the various existing food security schemes into legal entitlements (i.e.) from welfare based approach to rights based approach.

- It includes the Midday Meal Scheme, ICDS scheme and the PDS. It also recognizes maternity entitlements.

- Under NFSA, each beneficiaries is entitled to 5 kilograms of food grains per month at Rs.3, Rs.2, Rs.1 per kg for rice, wheat and coarse grains respectively.

- However, the beneficiaries under Antyodaya Anna Yojana will keep receiving the 35 Kg per household per month at same rates.

- It guarantees age appropriate meal, free of charge through local anganwadi for children up to 6 months and one free meal for children in age group 6-14 years in schools.

- Every pregnant and lactating mother is entitled to a free meal at the local anganwadi as well as maternity benefits of Rs 6,000, in instalments. Maternal benefits not extend to Government employees.

- The identification of eligible households is left to state governments.

Aam Admi Bima Yojana (AABY)

- AABY is a Government of India Social Security Scheme administered through Life Insurance Corporation of India (LIC).

- It provides Death and Disability cover to persons between the age group of 18 yrs. to 59 yrs.

- It is a group insurance scheme providing insurance cover for a sum of Rs 30,000/- on natural death, Rs. 75,000/- on death due to accident, Rs. 37,500/- for partial permanent disability due to accident and Rs. 75,000/- for total permanent disability due to accident.

- The total annual premium under the scheme is Rs. 200/- per beneficiary of which 50% is contributed from the Social Security Fund created by the Central Government and maintained by LIC. The balance is contributed by the State Government/ Nodal Agency/ Individual.

Varishtha Pension Bima Yojana

- It is a part of Government’s commitment for financial inclusion and social security.

- The scheme will be implemented through Life Insurance Corporation of India (LIC).

- It is to provide social security to elderly persons aged 60 years and above by giving an assured pension at a guaranteed rate of 8% per annum for 10 years.

- The differential return, i.e., the difference between the return generated by LIC and the assured return of 8% per annum would be borne by Government of India as subsidy on an annual basis.

Pradhan Mantri Awas Yojana – Housing for All (URBAN)

- It envisions Housing for All by 2022 and it subsumed Rajiv Awas Yojana and Rajiv Rinn Yojana.

- It seeks to address the housing requirement of urban poor including slum dwellers through following programme

- Slum rehabilitation with participation of private developers.

- Promotion of Affordable Housing for weaker section through Credit Linked Subsidy

- Affordable Housing in Partnership with Public & Private sectors

- Subsidy for beneficiary-led individual house construction

- It covers all 4041 statutory towns as per Census 2011 with focus on 500 Class I cities in three phases.

- Centre and State will be funding in the ratio of 75:25 and in case of North Eastern and special category States in the ratio of 90:10.

- Beneficiaries – Urban poor who does not own a pucca house, Economically Weaker Section (EWS) and Lower Income Groups (LIG – eligible only for credit linked subsidy scheme).

- States/UTs have flexibility to redefine the annual income criteria with the approval of Ministry.

- Under the mission, a beneficiary can avail of benefit of one component only.

- HUDCO and NHB have been identified as Central Nodal Agencies (CNAs) to channelize this subsidy to the lending institutions.

- Credit Linked Subsidy – It is an interest subsidy available to a loan amounts up to Rs 6 lakhs at the rate of 6.5 % for tenure of 20 years or during tenure of loan whichever is lower.

- The houses will be allocated preferably in the name of Women in the family.

Deendayal Antyodaya Yojana (DAY) – National Urban Livelihood Mission (NULM)

- It replaces the existing Swarna Jayanti Shahari Rozgar Yojana (SJSRY).

- NULM & NRLM has been subsumed into DAY.

- NULM aims at universal coverage of the urban poor for skill development and credit facilities.

- It focuses on organizing urban poor in their strong grassroots level institutions, creating opportunities for skill development and helping them to set up self-employment venture by ensuring easy access to credit.

- It is aimed at providing shelter equipped with essential services to the urban homeless in a phased manner and also addresses livelihood concerns of the urban street vendors.

- Funding will be shared between the Centre and the States in the ratio of 75:25. For North Eastern and Special Category – the ratio will be 90:10.

Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

- To enhance livelihood security in rural areas by providing at least 100 days of guaranteed demand based wage employment in a financial year to every household whose adult members volunteer to do unskilled manual work.

- Beneficiaries are willing rural population, unskilled manual labourers and seasonally unemployed.

- A 60:40 wage and material ratio has to be maintained.

- No contractors and machinery is allowed.

- Wages are linked to Consumer Price Index (Agriculture labour).

- The central government bears the 100 percent wage cost of unskilled manual labour and 75 percent of the material cost including the wages of skilled and semi-skilled workers.

- If work is not provided within 15 days of applying, applicants are entitled to an unemployment allowance.

- MGNREGA is to be implemented mainly by gram panchayats.

- At least one-third beneficiaries shall be women.

- Social audit has to be done by the gram sabha at least once in every 6 months.

- Focuses on creation of durable assets as per local needs.

Deen Dayal Antyodaya Yojana – NRLM

- National Rural Livelihood Mission/Aajeevika has been subsumed into Deen Dayal Antyodaya Yojana (DAY).

- The Scheme is assisted by investment from World Bank.

- It aims at creating efficient and effective institutional platforms of the rural poor, enabling them to increase household income through sustainable livelihood enhancements and improved access to financial services.

Features –

- Universal Social Mobilisation – At least one woman member from each identified rural poor household, is to be brought under the Self Help Group (SHG) network.

- Participatory identification of Poor – Target Group is identified through the Participators Identification of Poor (PIP) method and it is delinked from BPL. The responsibility of identification of poor must be vetted by the Gram Sabha and approved by the Gram Panchayat.

- Community Funds as Resources – NRLM provides Revolving Fund (RF) and Community Investment Fund (CIF) as resources in perpetuity to the institutions of the poor to strengthen their institutional and financial management capacity.

- Financial Inclusion – It promotes financial literacy among the poor.

- Livelihoods – It also promotes existing livelihood portfolio of the poor through its 3 pillars – ‘Vulnerability reduction and livelihoods enhancement’, ‘employment’ and ‘enterprises’.

- Partnerships with NGOs and linkages with Panchayat Raj institutions.

Pradhan Mantri Awas Yojana – Gramin

- It replaces Indira Awas Yojana (IAY), which was launched as a sub scheme of Jawahar Rozgar Yojana in 1985.

- IAY aims at helping rural people below the poverty-line (BPL) in construction of dwelling units and upgradation of existing unserviceable kutcha houses by providing assistance in the form of full grant.

- Beneficiaries are people belonging to SCs/STs, freed bonded labourers and non-SC/ST categories, widows or next-of-kin of defence personnel killed in action, ex-servicemen and retired members of the paramilitary forces, Disabled persons and Minorities.

- It will be implemented in rural areas across the country except Delhi and Chandigarh

- Government to construct 1 crore pucca (permanent) houses for the rural poor in the next three years.

- The project will be implemented in a span of three years and expected to boost job creation in rural areas.

- Beneficiaries of the rural houses would be chosen according to data taken from the Socioeconomic Caste Census of 2011

- An allowance of Rs. 120,000 in plain areas and Rs. 130,000 in hilly areas will be provided for construction of homes

- The unit size will be enhanced from the existing 20 sq.mt. to up to 25 sq.mt. including a dedicated area for hygienic cooking.

- Funds will be transferred electronically directly to the account of the beneficiary.

- The beneficiary would be facilitated to avail loan of up to Rs.70,000 for construction of the house which is optional.

Inequality

While the concept of poverty is rooted in the “lack of access” or “a low level of access” to food, nutrition, shelter, education and other services. Inequality is related to “unequal access” or “different degrees of access” of different individuals or groups of individuals to opportunities, services and benefits. Inequality is, thus, a more general concept than poverty. It looks at the relative levels of access of different groups to development opportunities and benefits.

Inequality in India: India is shining for only a select few. The impressive economic growth of our country has brought smiles on the faces of the rich and the powerful even as the rest suffer in distress and drudgery. This was revealed by the Human Development Report, 2011 (HDR) released by Planning Commission. The report highlights the skewed income and wealth distribution in India and the widening gap between the rich and the poor. According to HDR 2011, inequality in India for the period 2000-11 in terms of the income Gini coefficient was 36.8.

Types of Inequality

There are three important types of inequality exist in India, namely inequality in income and consumption, inequality in assets and regional inequality. These three forms of inequality are interrelated and mutually reinforcing. The Government of India has been concerned about rising inequalities and uneven distribution of the benefits of growth.

Inequality in Income and Consumption: Consumer expenditure of households is a good proxy for income, at least in the lower classes. A study of inequalities in levels of consumption will by itself be useful in an economy where agriculture, the unorganised sector, payment of wages in kind and the non-monetised sector still play an important role.

If we turn to levels of inequality in consumption, the household consumer expenditure surveys of the NSSO provide the levels of consumption of expenditure in the population by Monthly Per capita Consumer Expenditure (MPCE) classes. The Average MPCE of the rural people in India is only Rs.1054 and in Urban it is Rs.1984. The inequality situation is worse in urban areas than in rural areas. Inequality in consumption is declining, albeit slowly, in rural areas according to all measures of inequality. On the other hand, urban inequality shows no sign of any decline.

Inequality in Assets: Incomes are derived from two main sources. Namely, assets like land, cattle, shares and labour etc. In India a few own a large chunk of income-earning assets therefore the distribution of assets is extremely unequal. Asset accumulation is minimal among the agricultural labour households in rural areas and casual labour households in urban areas. But the asset distribution is even more unequal in the urban than in the rural areas.

Regional Inequality: Third important type of inequality that India faces is the regional inequality. Some states are economically and socially advanced while others are backward. Even within each state some regions are more developed while others are primitive. The co-existence of relatively developed and economically depressed states and even regions within each state is known as regional inequality. The existence of regional inequality creates social, economic and political issues. The regional inequality is so prominent in India in the case of HDI Value, growth of the economy, poverty, unemployment, education, health, monthly per capita expenditure, rural- urban divide etc.

Causes of regional inequality:

- Historical Factors

- Geographical factors

- Infrastructure

- Decline in Public Investment

Kuznets Curve:

Kuznets Curve is used to demonstrate the hypothesis that economic growth initially leads to greater inequality, followed later by the reduction of inequality. The idea was first proposed by American economist Simon Kuznets.

As economic growth comes from the creation of better products, it usually boosts the income of workers and investors who participate in the first wave of innovation. The industrialisation of an agrarian economy is a common example. This inequality, however, tends to be temporary as workers and investors who were initially left behind soon catch up by helping offer either the same or better products. This improves their incomes.

Environmental Kuznets Curve:

The environmental Kuznets curve suggests that economic development initially leads to a deterioration in the environment, but after a certain level of economic growth, a society begins to improve its relationship with the environment and levels of environmental degradation reduces.

From a very simplistic viewpoint, it can suggest that economic growth is good for the environment.

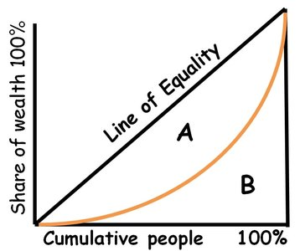

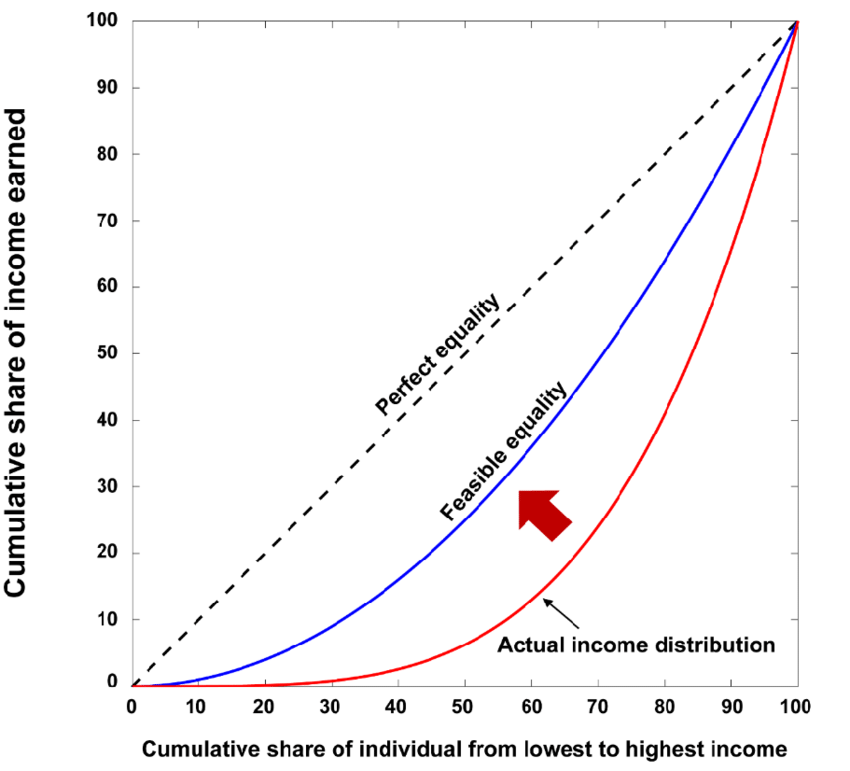

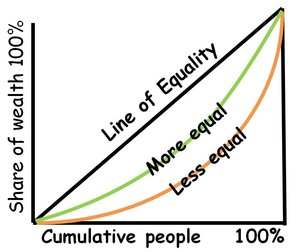

Lorentz Curve

The distribution of Income in an economy is represented by a Lorenz Curve and the degree of income inequality is measured through the Gini Coefficient. One of the five major and common macroeconomic goals of a government is the equitable (fair) distribution of income.

The Lorenz Curve (the actual distribution of income curve), a graphical distribution of wealth developed by Max Lorenz in 1906, shows the proportion of income earned by any given percentage of the population. The line at the 45º angle shows perfectly equal income distribution, while the other line shows the actual distribution of income. The further away from the diagonal, the more unequal the size of distribution of income.

In the below example, the Lorenz Curve, which represents the actual distribution of income in a country, shows how the poorest 20% of the population only earn 5% of the national income in this population. While in a case of perfect equality, the poorest 20% of the population would earn 20% of the income. The more bowed out a Lorenz Curve, the greater is the inequality of income in the country.

Interpreting Lorenz Curve:

The Gini Coefficient

The Gini Coefficient, which is derived from the Lorenz Curve, can be used as an indicator of economic development in a country. The Gini Coefficient measures the degree of income equality in a population.

The Gini Coefficient is equal to the area between the actual income distribution curve and the line of perfect income equality, scaled to a number between 0 and 100. The Gini coefficient is the Gini index expressed as a number between 0 and 1.

The Gini Coefficient can vary from 0 (perfect equality) to 1 (perfect inequality). A Gini Coefficient of zero means that everyone has the same income, while a Coefficient of 1 represent a single individual receiving all the income.