- Definition of Money and Capital Markets

- Importance and Relevance of Money and Capital Markets

- Compounding and Discounting

- Bonds, Bond Yield

- Money Market Instruments

- Types of Investors

- Depository Institutions

- Equity Market

- Stock Exchanges (BSE and NSE)

- Debt Market

- Credit Rating Agencies

- Derivative Market

“Financial market” is a phrase used to denote the total infrastructure which facilitates the trade of financial securities.

Financial securities can be like currency, bonds, stocks, derivatives, commodities, forex etc.

Structure of Financial Market in India:

Definition of Money Market and Capital Markets

- A component of financial market that facilitates short term borrowing, lending, buying and selling.

- A capital market is a component of a financial market that allows long-term trading of debt and equity-backed securities.

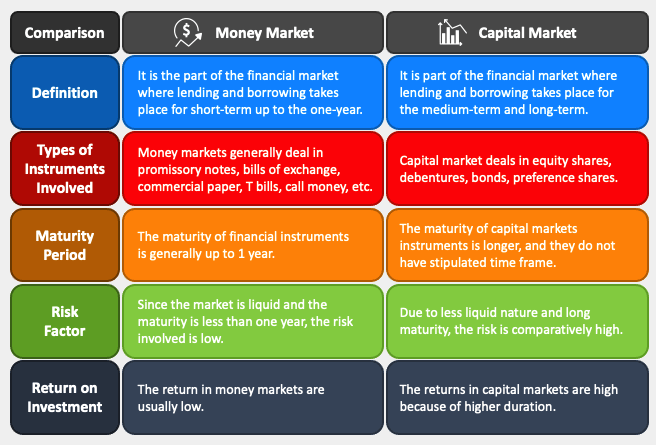

Difference between Money Market and Capital Markets:

| Basis for Comparison | Money Market | Capital Market |

|---|---|---|

| Meaning | A segment of the financial market where lending and borrowing of short term securities are done. | A section of financial market where long term securities are issued and traded. |

| Financial instruments | Treasury Bills, Commercial Papers, Certificate of Deposit, Trade Credit etc. | Shares, Debentures, Bonds, Retained Earnings, Asset Securitization, Euro Issues etc. |

| Institutions | Central bank, Commercial bank, non-financial institutions, bill brokers, acceptance houses, and so on. | Commercial banks, Stock exchange, non-banking institutions like insurance companies etc. |

| Risk Factor | Low | Comparatively High |

| Liquidity | High | Low |

| Purpose | To fulfil short term credit needs of the business. | To fulfil long term credit needs of the business. |

| Time Horizon | Within a year | More than a year |

| Merit | Increases liquidity of funds in the economy. | Mobilization of Savings in the economy. |

| Return on Investment | Less | Comparatively High |

Importance and Relevance of Money and Capital Markets

A developed money and capital market plays an important role in the financial system of a country by supplying short-term funds and long-term funds to trade and industry. These markets are integral part of a country’s economy.

Therefore, a well-developed(fair and competitive) money market and capital market is highly indispensable for the rapid development of the economy. These market helps the smooth functioning of the financial system in any economy.

Importance of Money Markets

- Development Of Trade And Industry: The money market, through discounting operations and commercial papers, finances the short-term working capital requirements of trade and industry and facilities the development of industry and trade both – national and international.

- Development Of Capital Market: The short-term rates of interest and the conditions that prevail in the money market influence the long-term interest as well as the resource mobilization in capital market. Hence, the development of capital depends upon the existence of a development of money market.

- Smooth Functioning of Commercial Banks: The money market provides the commercial banks with facilities for temporarily employing their surplus funds in easily realizable assets. The banks can get back the funds quickly, in times of need, by resorting to the money market. The commercial banks gain immensely by economizing on their cash balances in hand and at the same time meeting the demand for large withdrawal of their depositors. It also enables commercial banks to meet their statutory requirements of cash reserve ratio (CRR) and Statutory Liquidity Ratio (SLR) by utilizing the money market mechanism.

- Effective Central Bank Control: A developed money market helps the effective functioning of a central bank. It facilities effective implementation of the monetary policy of a central bank. The central bank, through the money market, pumps new money into the economy in slump and siphons if off in boom. The central bank, thus, regulates the flow of money so as to promote economic growth with stability.

- Formulation Of Suitable Monetary Policy: Conditions prevailing in a money market serve as a true indicator of the monetary state of an economy. Hence, it serves as a guide to the RBI in formulating and revising the monetary policy then and there depending upon the monetary conditions prevailing in the market.

- Non-Inflationary Source Of Finance To Government: A developed money market helps the Government to raise short-term funds through the treasury bills floated in the market. In the absence of a developed money market, the Government would be forced to print and issue more money or borrow from the central bank. Both ways would lead to an increase in prices and the consequent inflationary trend in the economy.

Importance of Capital Markets

- It is only with the help of capital market, long-term funds are raised by the business community.

- It provides opportunity for the public to invest their savings in attractive securities which provide a higher return.

- A well-developed capital market is capable of attracting funds even from foreign country. Thus, foreign capital flows into the country in the form of foreign investment.

Compounding and Discounting

The value of one rupee today will be decreased or increased in future i.e., Time Value of Money says that the worth of a unit of money is going to be changed in future.

There are two methods used for ascertaining the worth of money at different points of time, namely, compounding and discounting.

Compounding method is used to know the future value of present money. Conversely, Discounting is a way to compute the present value of future money.

- Compounding refers to the process of earning interest on both the principal amount, as well as accrued interest by reinvesting the entire amount to generate more interest. Compounding is the method used in finding out the future value of the present investment.

- Discounting is the process of converting the future amount into its Present Value. The discounting technique helps to ascertain the present value of future cash flows by applying a discount rate.

Future Value : The money you invest today, will grow and earn interest on it, after a certain period, which will automatically change its value in future. So the worth of the investment in future is known as its Future Value.

Present value : The current value of the given future value is known as Present Value.

Q. Consider the following:

1. Call Money Market

2. Treasury Bill Market

3. Stock Market

How many of the above are included in capital markets?

(a) Only one

(b) Only two

(c) Only three

(d) All four

Bonds, Bond Yield

A bond is a loan that the bond purchaser, or bondholder, makes to the bond issuer. Governments, corporations and municipalities issue bonds when they need capital.

An investor who buys a government bond is lending the government money. If an investor buys a corporate bond, the investor is lending the corporation money. Like a loan, a bond pays interest periodically and repays the principal at a stated time, known as maturity.

Bond Yield

It is the return a buyer will earn from a bond. The yield differs from the coupon rate as it considers the market price of a bond. The coupon rate considers the face value.

What are the types of bond yields?

Current yield: Calculated by taking into account the interest paid and the market value. A bond with a face value of Rs 1,000 and market value of Rs 800 pays 8% coupon rate. The current yield is 10% (80/800) X 100.

- If market price is higher than face value then current yield will be lower than coupon rate.

- If market price is lower than face value then current yield will be higher than coupon rate.

- If market price equals face value then yield will be equal to coupon rate.

Yield to maturity (YTM): It is the rate that a bond holder will earn if the bond is held till maturity.

Bond yields and prices: Yields and prices are inversely related. Price of bonds issued in the past gets adjusted according to changes in yields/interest rates. The market price of a bond with a face value of Rs 1,000 at a coupon rate of 8% will come down to Rs 800 if interest rates/yield goes up to 10%. This is because at 10%, a newly issued bond with a face value of Rs 800 will fetch the same interest of Rs 80 that the previously issued Rs 1,000 face value bond was generating at 8%. On the other hand, if interest rates/yields falls to say 6%, the market price of the bond will increase to Rs 1,333.

Why bond yields matter ?

Evaluating economic outlook: A rising yield curve indicates increase in interest rates in the future whereas a falling yield curve signals economic slowdown.

Gauging investor sentiments: Bond yields of creditworthy nations help judge global investor sentiments. Falling yields of such nations could mean a likely equity market correction.