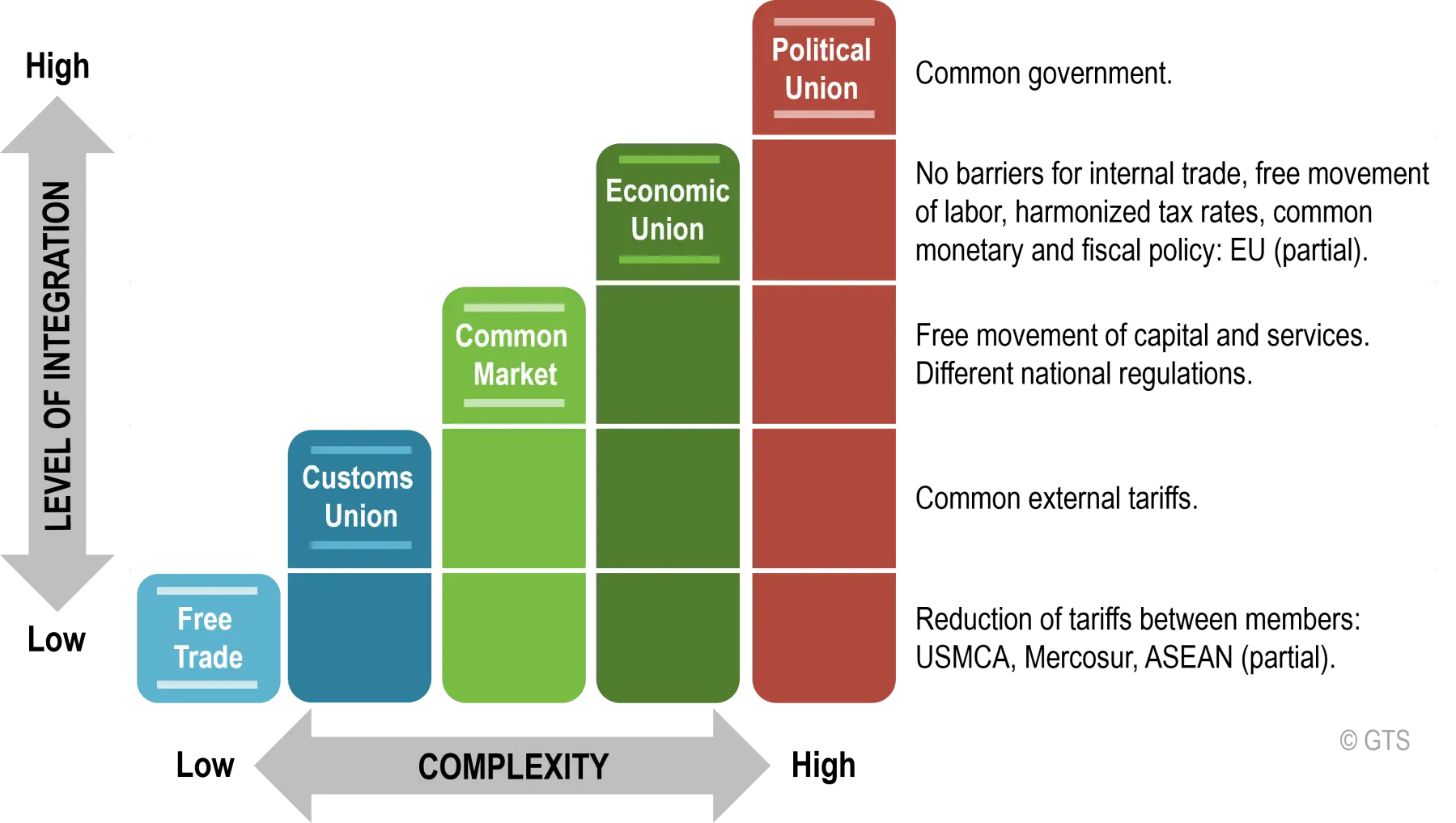

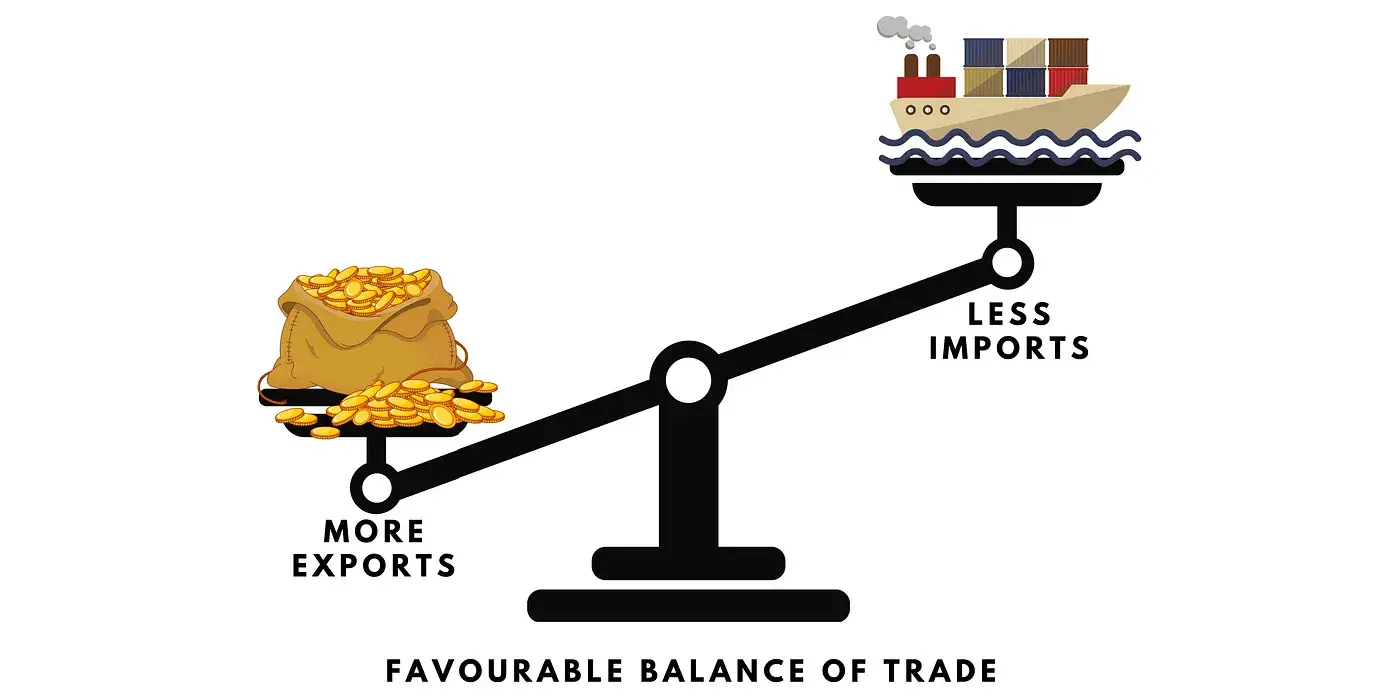

Globalization, Deglobalization and Reglobalization The idea of globalization Free Trade Vs Protectionism Barriers of Trade Stages of Economic Integration World Trade Organization, as an institution was established in 1995. It replaced General Agreement on Trade and Tariffs (GATT) which was in place since 1946. About WTO: The World Trade Organization (WTO) is the only global […]